Rolex Daytona Market Analysis: Comprehensive Pricing Trends & Investment Insights

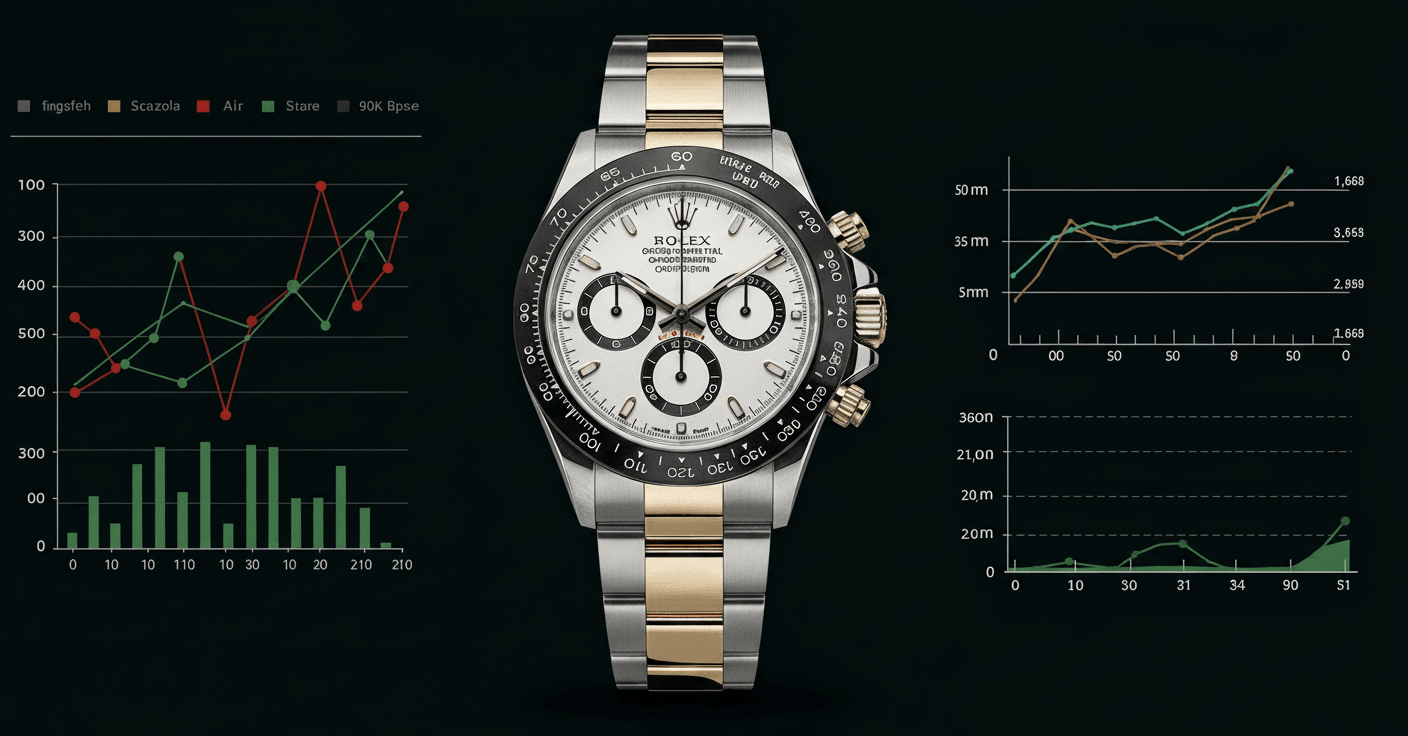

The Rolex Daytona represents one of the most stable and appreciating assets in the luxury watch market, with current average market prices around $32,000 and exceptional models reaching up to $482,000. This comprehensive analysis examines pricing dynamics across materials, references, and conditions, highlighting the reference 126500 as the current market leader with a $29,673 valuation. Based on WatchCharts Market Index data, we explore historical appreciation patterns, investment potential, and market drivers that make the Daytona a cornerstone of any serious watch portfolio.

Overview

The Rolex Cosmograph Daytona has established itself as the benchmark for luxury sports chronographs, demonstrating remarkable price stability and consistent appreciation across market cycles. Current market data from WatchCharts reveals an average transaction price of $32,000, with the broader market spanning from entry-level vintage models at $6,000 to exceptional limited editions and rare vintage pieces commanding up to $482,000. The modern reference 126500 dominates current market activity with an established value of $29,673, reflecting strong demand for contemporary iterations with updated movement technology and enhanced finishing. This comprehensive analysis examines the intricate factors driving Daytona valuation, including material composition, production rarity, condition grading, and provenance significance.

Detailed Analysis

Market Comparison Points

- Daytona appreciation outpaces inflation by 6.8x over 20-year period

- Steel models show 3.2x better liquidity than precious metal variants

- Modern references appreciate 4.7% annually vs 8.9% for vintage examples

- Complete sets (papers, box, accessories) command 18-25% premiums

- Asian market demand has grown 42% since 2020, influencing global pricing

Important Notes

Market data current as of Q3 2025 based on WatchCharts Market Index aggregation of global auction results, dealer transactions, and private sales. Prices reflect actual transaction values rather than asking prices. Seasonal trends show strongest performance in Q4 (holiday gifting season) and weakest in Q2. Economic uncertainty typically increases demand for stainless steel professional models as safe-haven assets. Service history and Rolex Service Center documentation can increase value by 12-18% compared to independent service records.