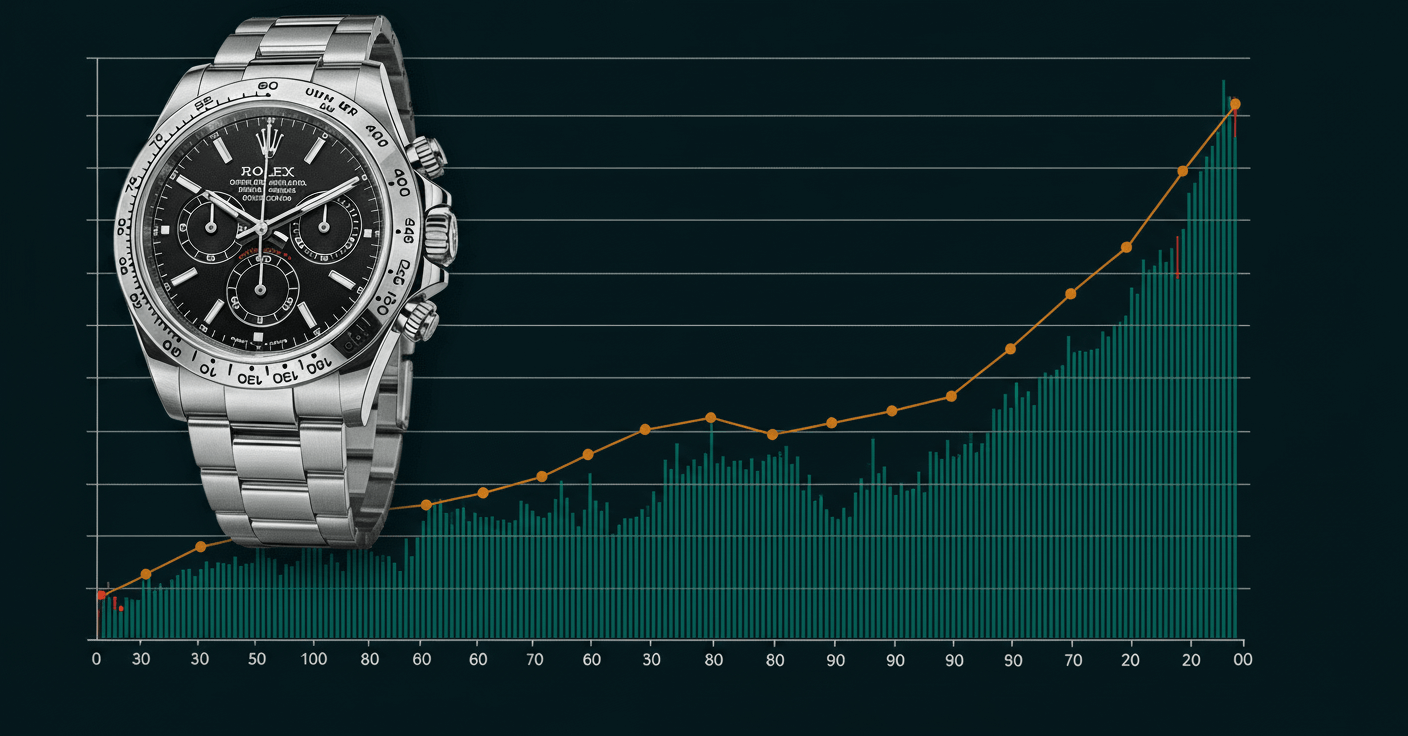

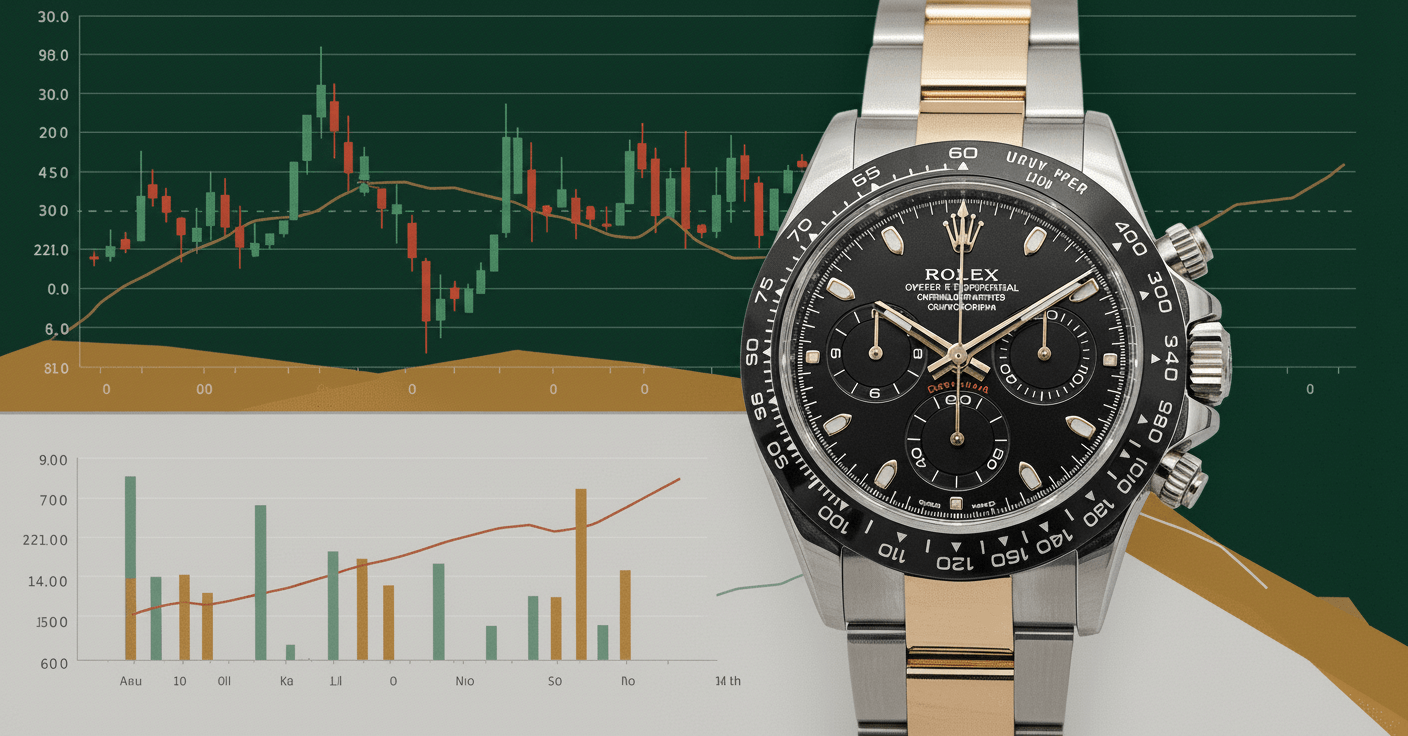

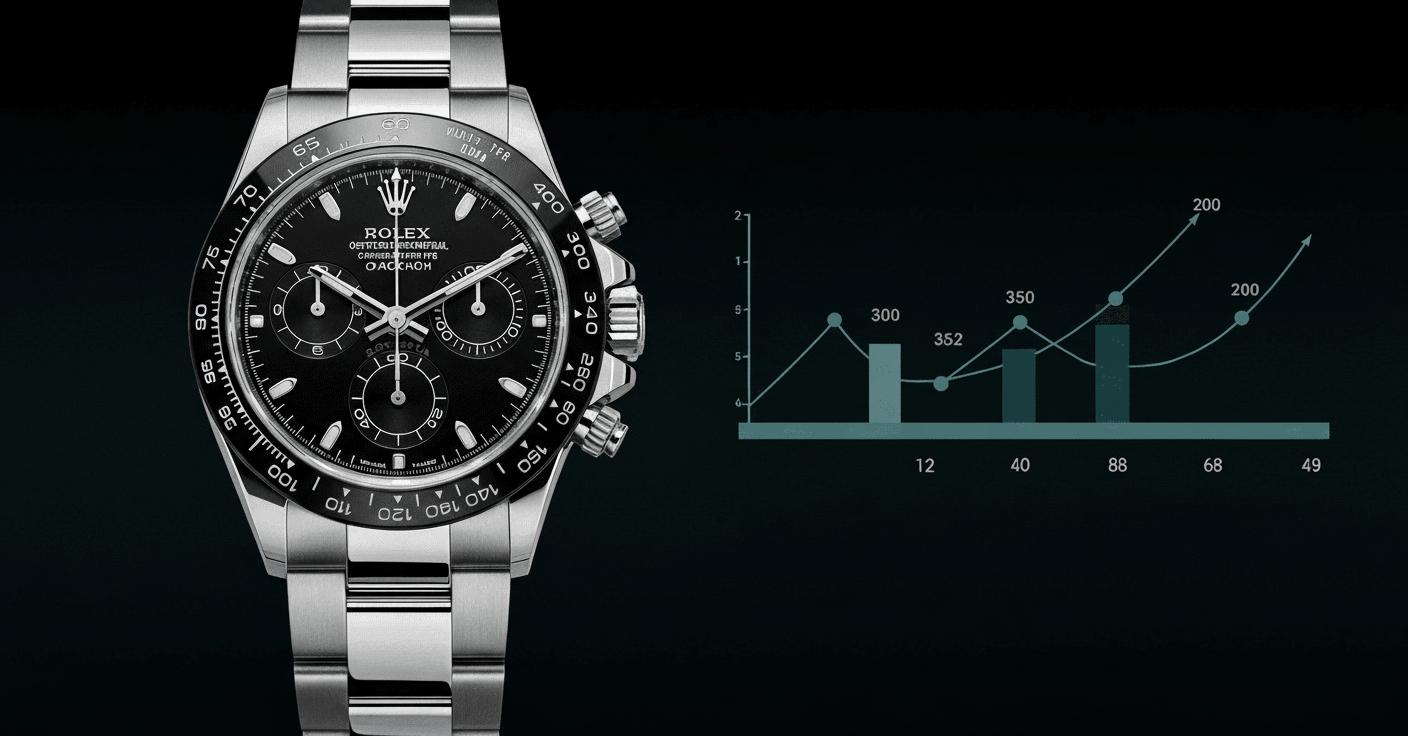

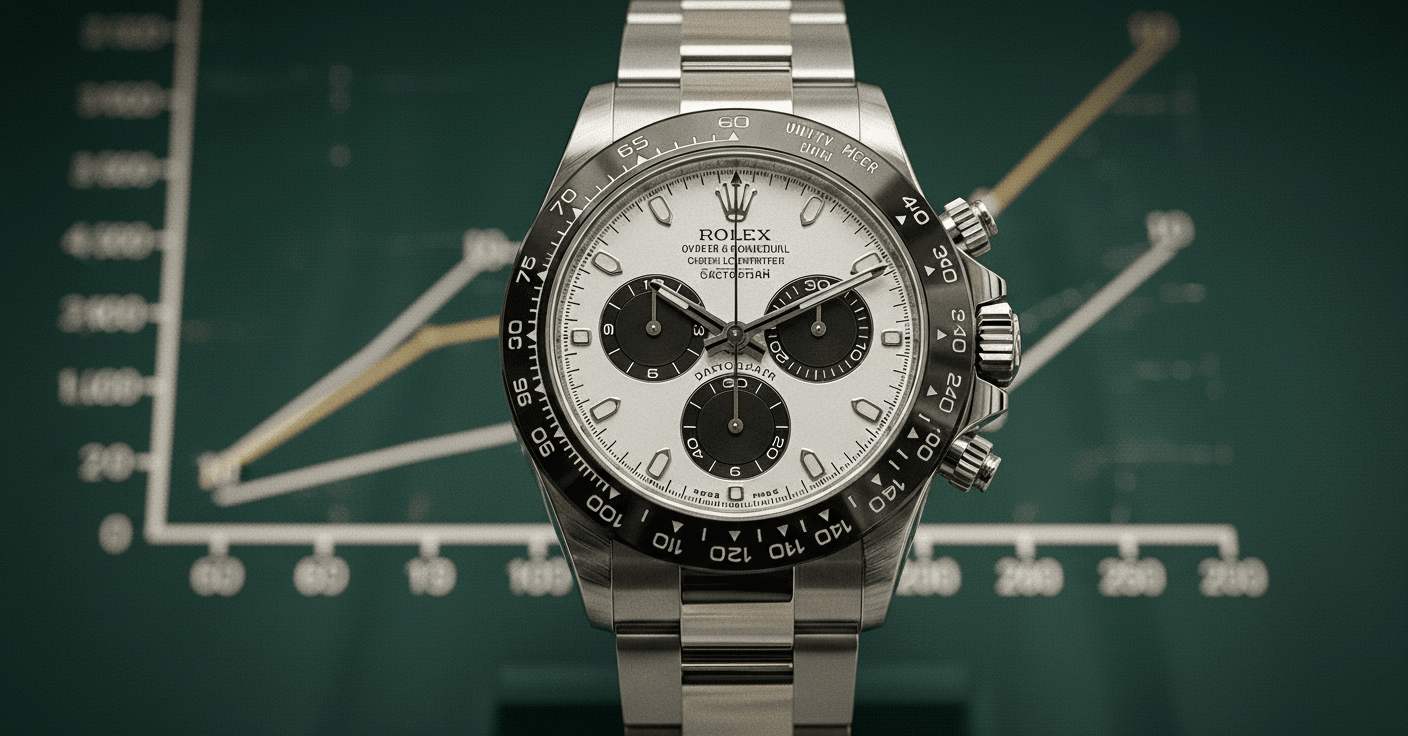

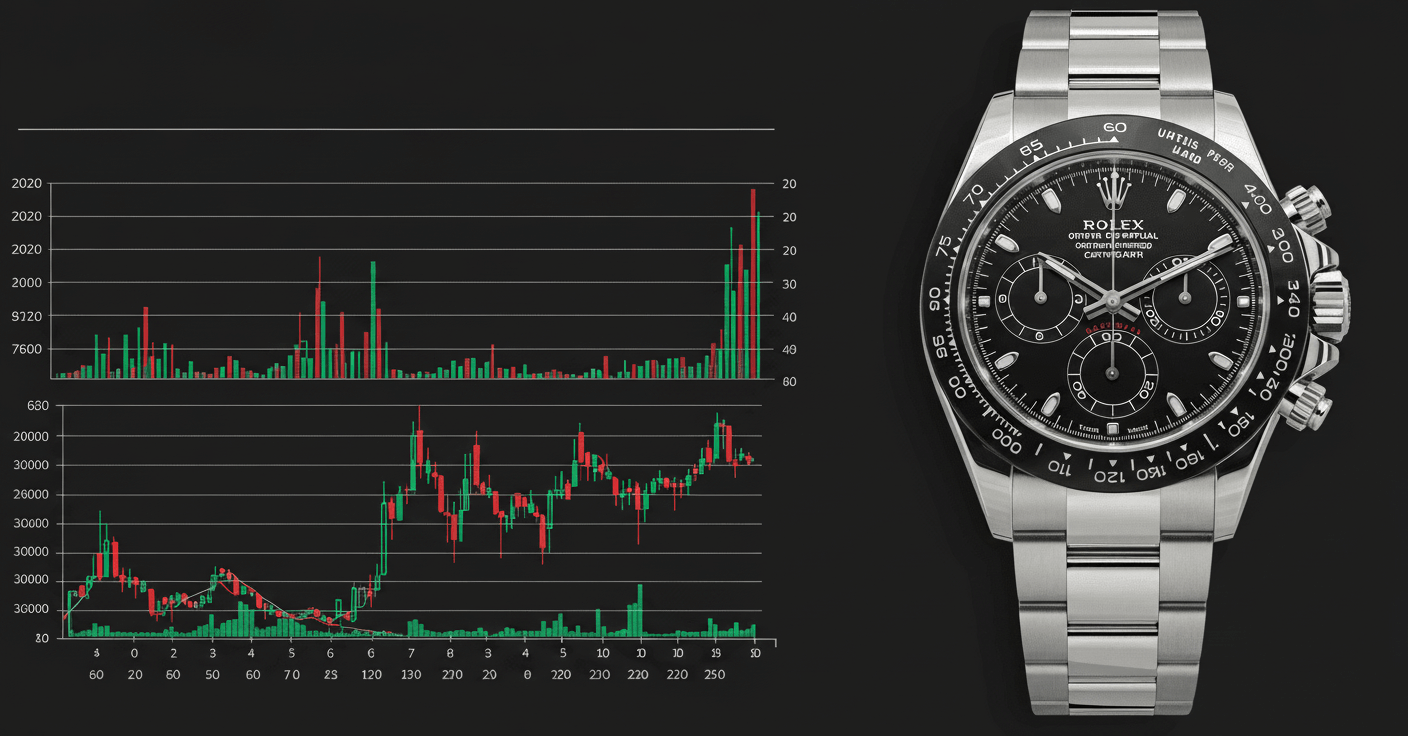

Rolex Daytona Market Volatility: Complete Price Analysis 2022-2023

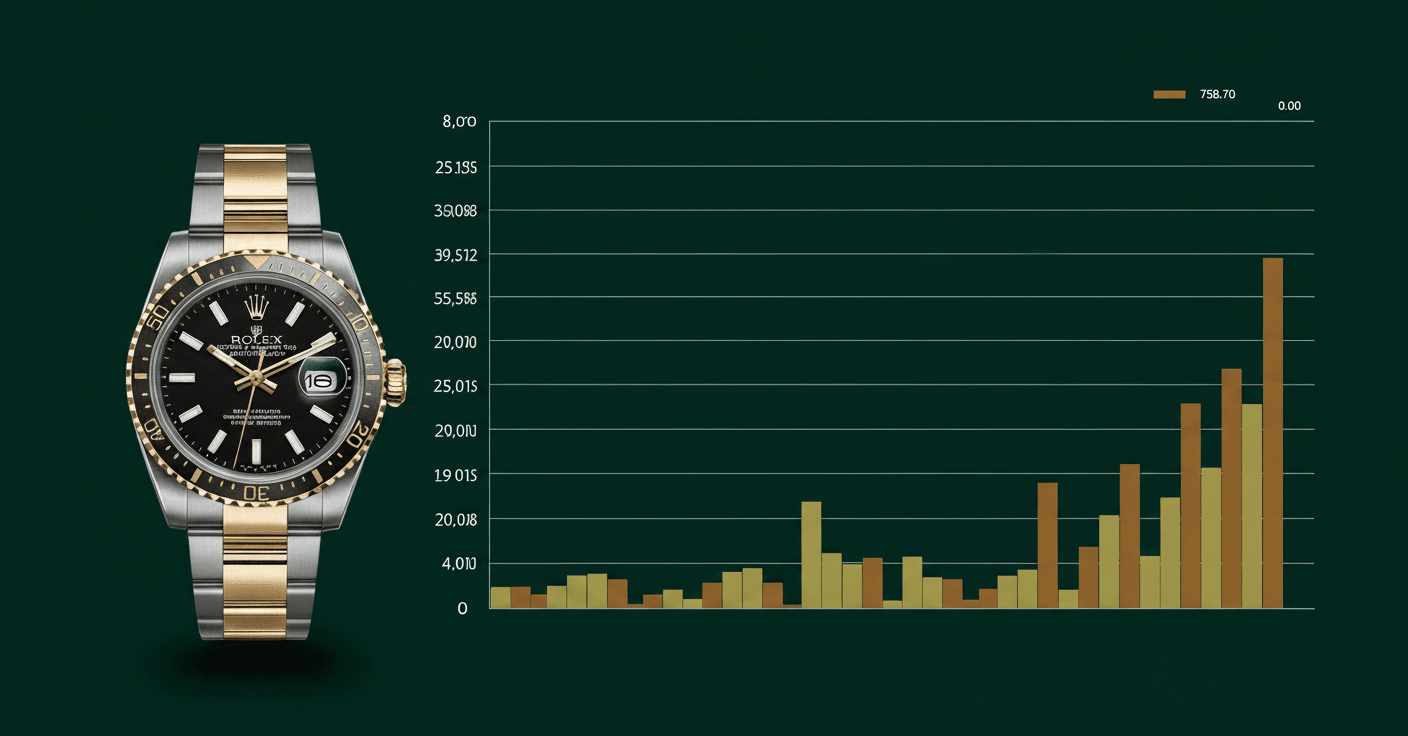

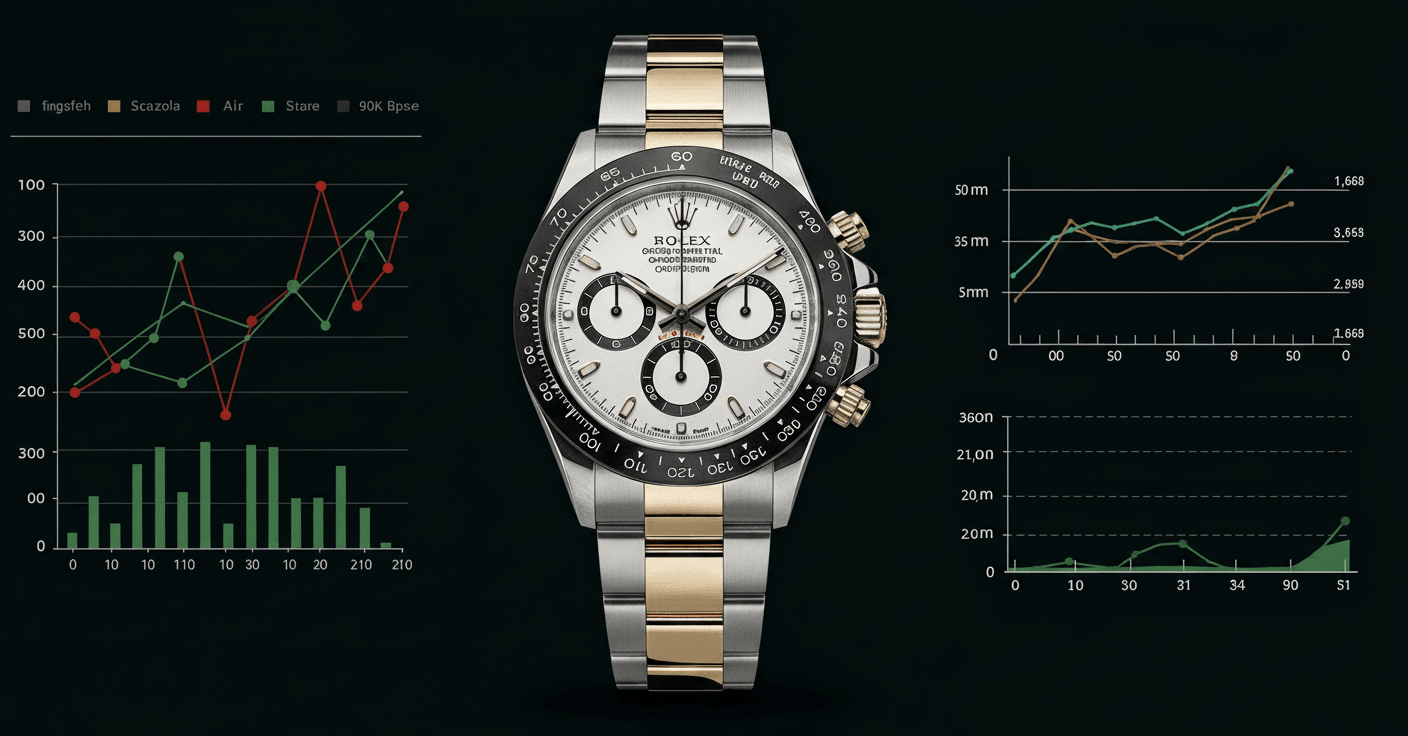

The Rolex Daytona experienced unprecedented market volatility between 2022-2023, with prices peaking at $53,911 in March 2022 before collapsing 51% to $27,642 in January 2023. The subsequent 43% recovery to $37,995 demonstrates extreme speculative dynamics in luxury watch markets. This comprehensive analysis examines the factors driving these dramatic fluctuations, including macroeconomic conditions, collector sentiment shifts, and market speculation patterns that created one of the most volatile periods in modern watch collecting history.