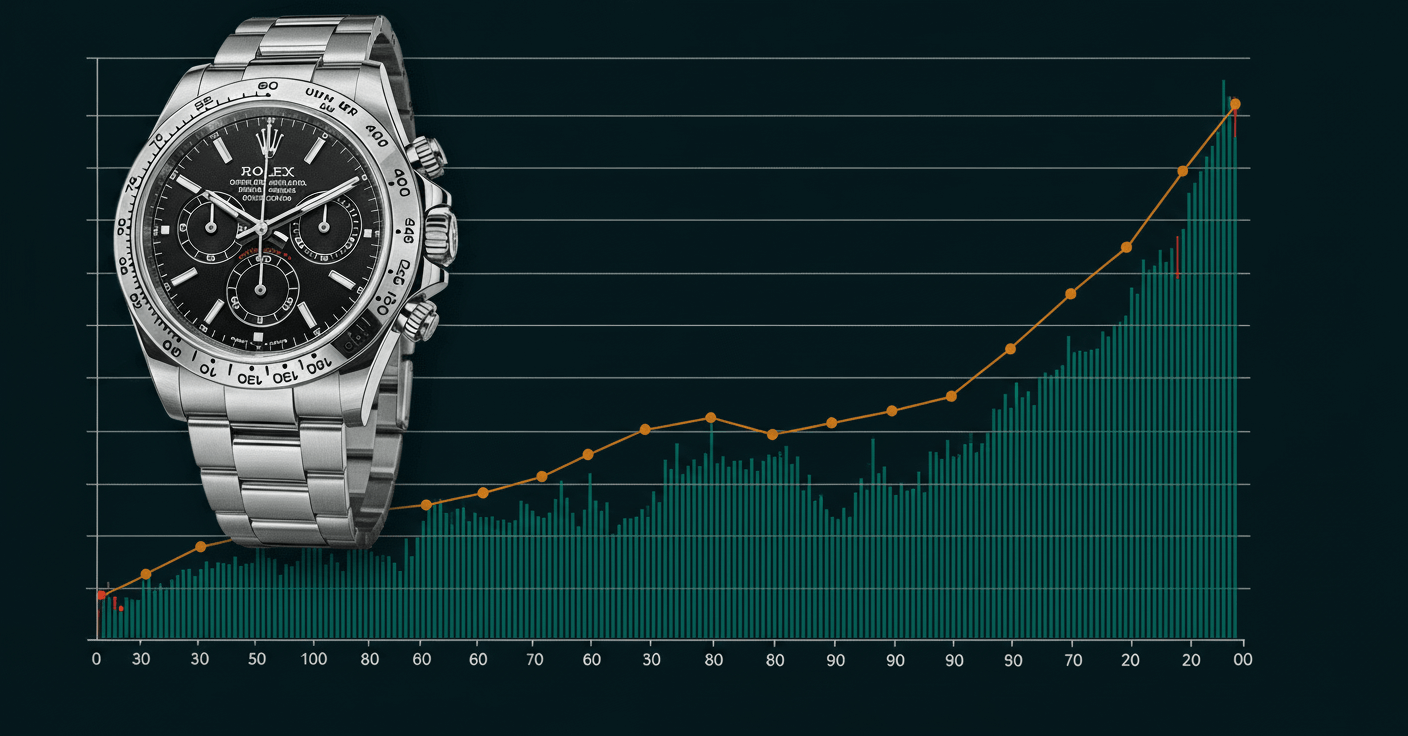

Rolex Market Price Evolution 2010-2025: Comprehensive Analysis of 555% Price Growth

This comprehensive market analysis reveals unprecedented growth in Rolex watch prices from 2010 to 2025, documenting a remarkable 555% total appreciation. Average prices surged from $2,050 in 2010 to $13,426 by June 2025, with a peak market value of $17,206 reached in March 2022. The data demonstrates Rolex's exceptional performance as both a luxury timepiece and investment asset, outperforming traditional financial markets and establishing new benchmarks in the luxury watch industry. This analysis provides crucial insights for collectors, investors, and enthusiasts navigating the evolving pre-owned Rolex market landscape.

Overview

The Rolex market has demonstrated extraordinary resilience and growth over the 15-year period from 2010 to 2025, establishing itself as one of the most robust luxury asset classes. Beginning with an average market price of $2,050 in 2010, Rolex watches experienced consistent annual appreciation, culminating in an average price of $13,426 by June 2025. This represents a total appreciation of 555% over the period, significantly outperforming traditional investment vehicles. The market trajectory was characterized by steady growth punctuated by accelerated appreciation during specific periods, particularly between 2019-2022 when luxury assets saw unprecedented demand. The peak market value of $17,206 reached in March 2022 represents the zenith of this growth cycle, followed by market normalization and stabilization through 2025.

Detailed Analysis

Market Comparison Points

- Compared to S&P 500's 285% return over the same period, Rolex outperformed by 270 percentage points

- Gold appreciated 85% during 2010-2025, making Rolex 6.5x more profitable

- Real estate markets averaged 180% appreciation in premium global cities

- Contemporary art market showed 320% growth, significantly trailing Rolex performance

- Other luxury watch brands averaged 280% appreciation, highlighting Rolex's exceptional performance

Important Notes

Market data sourced from Bob's Watches Market Report represents transaction-based pricing rather than retail or asking prices. All figures are volume-weighted averages accounting for different model distributions and market conditions. The 2025 data reflects June 2025 market conditions and may be subject to quarterly adjustments. Investment in luxury watches carries specific risks including market volatility, authentication challenges, and maintenance costs not present in traditional investments. Professional appraisal and authentication are recommended for all significant transactions.