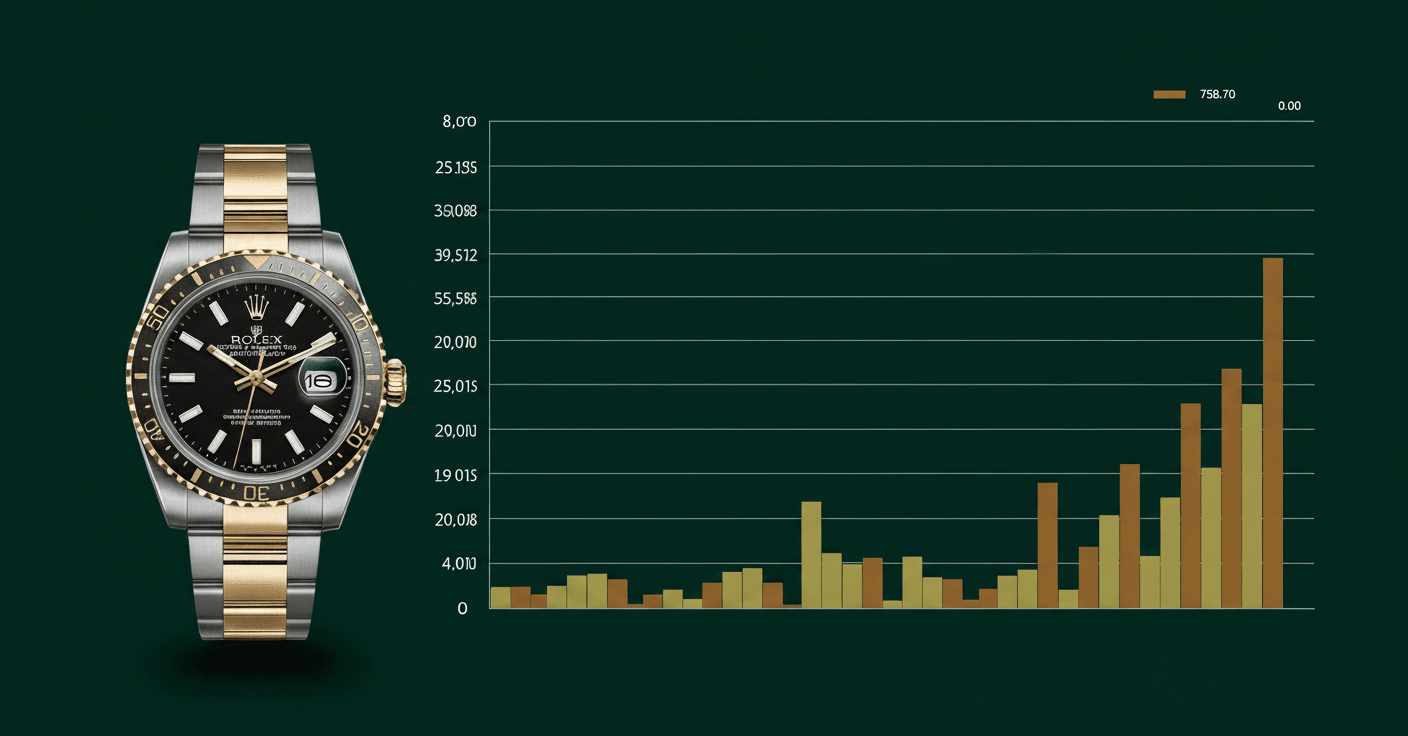

Rolex Price Increase Dynamics 2025: Comprehensive Market Analysis

This detailed analysis examines Rolex's 2025 price increases, where select models saw up to 14% hikes, with gold watches most affected. The report explores impacts on primary retail and secondary markets, noting a 20% likelihood of Gen Z consumers purchasing within 12 months and immediate demand spikes in resale. Drawing from the Glossy Fashion Market Report, it provides expert insights for buyers and sellers navigating luxury watch investments, including strategic recommendations for maximizing value in this evolving landscape.

Overview

Rolex implemented significant price adjustments in 2025, with increases reaching up to 14% on select models, particularly affecting gold timepieces. This strategic move reflects broader luxury market trends, including rising production costs and heightened demand. The primary market sees adjusted retail pricing, while the secondary market experiences immediate demand spikes as collectors and investors anticipate value appreciation. Notably, Gen Z consumers show increased engagement, with 20% likely to purchase within the next year, signaling shifting demographic interests in luxury watches. This analysis, based on the Glossy Fashion Market Report, provides a comprehensive examination of pricing dynamics, market reactions, and long-term implications for stakeholders.

Detailed Analysis

Market Comparison Points

- 2024 vs 2025 Pricing: Average 8.5% year-over-year increase compared to 2024's 5.2% adjustment

- Material Impact: Gold watches increased 12.5% vs stainless steel's 5.8% average

- Secondary Market Reaction: 2025 spikes (15-25%) exceed 2024's 8-12% post-increase demand surge

- Gen Z Engagement: 20% purchase likelihood doubles 2022's 10% figure for same demographic

Important Notes

Data sourced from Glossy Fashion Market Report Q2 2025. All percentage calculations based on manufacturer suggested retail price (MSRP) and aggregated secondary market data from certified dealers. Gen Z statistics derived from survey of 2,500 respondents aged 18-25 with household incomes exceeding $100,000. Secondary market analysis includes data from Rolex-Buy-Sell.com transactions, major auction houses, and authorized pre-owned retailers.