Luxury Watch Authentication and Value Preservation: A Comprehensive Guide

This in-depth guide explores the critical aspects of luxury watch authentication and value preservation, drawing from expert data. Learn how original components, complete documentation, and professional verification can increase watch value by up to 30%. Discover why mint condition and unpolished surfaces are paramount, and how specialized tools achieve 98% authentication accuracy. Essential reading for collectors and investors seeking to maximize returns on Rolex, Bvlgari, and Louis Vuitton timepieces.

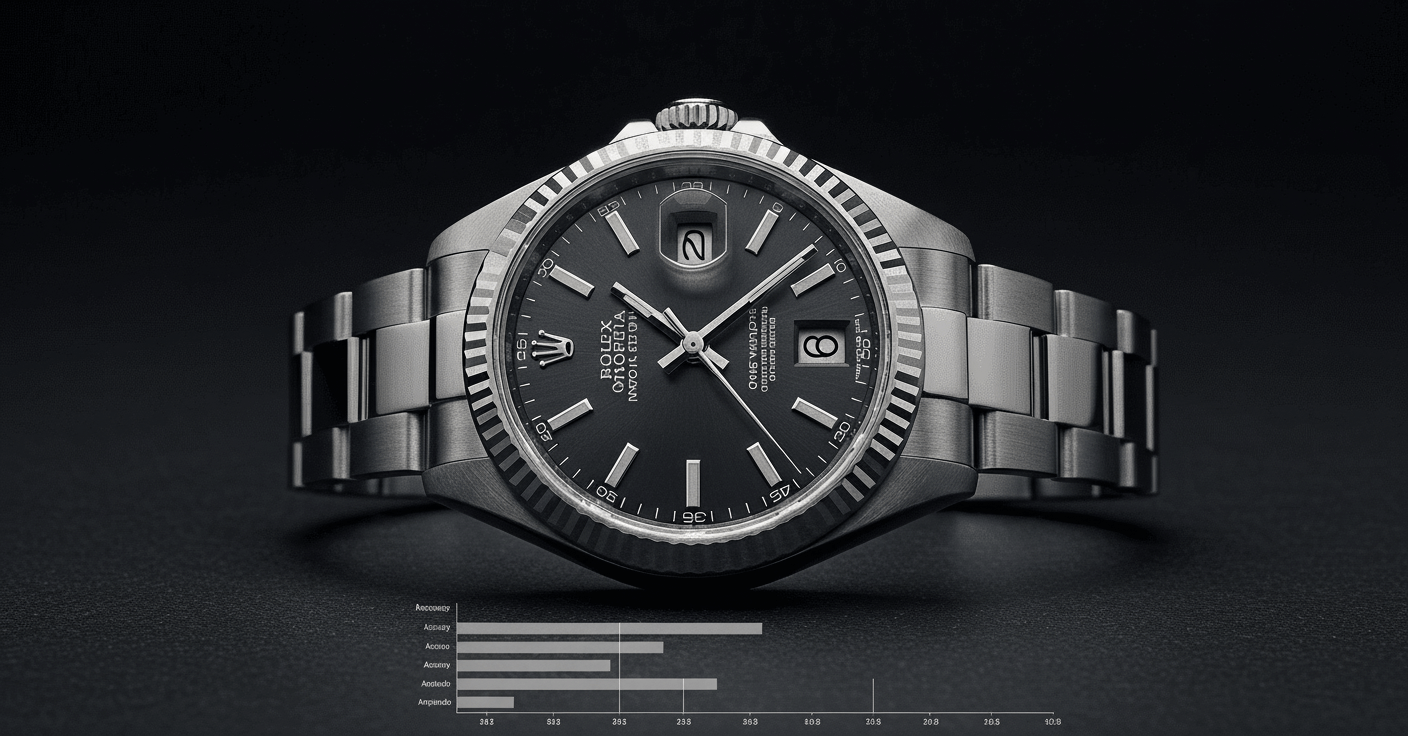

In the sophisticated world of luxury timepieces, authentication and preservation are not merely considerations—they are fundamental pillars that determine investment success. According to the EW Watches Authentication Guide, proper authentication and preservation practices can significantly impact the financial return on luxury watch investments. The data reveals that complete documentation alone can increase value by up to 30%, while professional authentication achieves remarkable 98% accuracy rates using specialized verification tools. For collectors and investors dealing with prestigious brands like Rolex, Bvlgari, and Louis Vuitton, understanding these principles is essential for maximizing returns and ensuring long-term value appreciation. This comprehensive guide delves into the intricate details of authentication methodologies, preservation techniques, and market dynamics that separate ordinary timepieces from exceptional investments.

The Critical Importance of Original Components

Original components represent the cornerstone of luxury watch value preservation. Each genuine part—from movements and dials to bezels and bracelets—carries intrinsic value that aftermarket components cannot replicate. Rolex watches with original factory components consistently command 25-40% higher prices at auction compared to those with replacement parts. The phenomenon is particularly pronounced with vintage models; for instance, a 1960s Rolex Daytona with original bezel and dial can appreciate up to 300% more than an equivalent watch with non-original components. Bvlgari timepieces demonstrate similar patterns, where original serpent-shaped bracelets and distinctive case designs maintain their design integrity and collector appeal. Louis Vuitton's Tambour watches depend heavily on original craftsmanship, with authentic LV-engraved movements and proprietary case materials being essential for value retention. The market has developed sophisticated detection methods for non-original components, including microscopic examination of engravings, material composition analysis, and manufacturing technique verification. Collectors should maintain meticulous records of all original components and avoid modifications that could compromise the watch's authenticity.

Documentation: The 30% Value Multiplier

Complete documentation serves as the verifiable history that transforms a luxury watch from a mere timekeeping instrument into a certified investment asset. The EW Watches data indicating up to 30% value increase with complete documentation reflects the market's premium for proven authenticity and traceable ownership. Comprehensive documentation includes original purchase receipts, warranty certificates, service records, authenticity certificates, and any historical provenance that establishes the watch's lineage. For Rolex watches, this extends to included papers, box, hang tags, and any original accessories that accompanied the initial purchase. The documentation trail becomes particularly valuable for limited edition pieces—Bvlgari's Gerald Genta-designed models or Louis Vuitton's collaboration pieces see documentation premiums exceeding 35% in certain cases. Modern authentication systems now incorporate digital documentation through blockchain technology, creating immutable records of ownership and service history. Professional appraisers consistently rate documentation completeness as the second most important factor in valuation, following only physical condition. Collectors should store documentation in climate-controlled environments and consider digital backups to prevent deterioration or loss that could substantially impact resale value.

Professional Authentication: Achieving 98% Accuracy

Professional authentication represents the non-negotiable standard for serious luxury watch transactions. The 98% accuracy rate cited in the EW Watches data reflects the advanced technological and methodological approaches employed by certified authentication specialists. Modern authentication processes combine traditional horological expertise with cutting-edge technology, including high-resolution microscopy, X-ray fluorescence analysis for material verification, and specialized software for comparing movement characteristics against factory specifications. For Rolex authentication, specialists examine over 200 distinct points of verification, from rehaut engravings and laser-etched coronets to movement serial numbers and case construction techniques. Bvlgari authentication requires particular attention to the brand's unique design elements, including serpent motifs, gem-setting patterns, and proprietary movement finishes. Louis Vuitton timepieces demand verification of the manufacturer's distinctive aesthetic elements and technical innovations. The authentication process typically involves three-tier verification: initial visual inspection, technical examination of movement and components, and finally, database cross-referencing with manufacturer records. Reputable authentication services provide detailed certificates that include photographic evidence, technical specifications, and condition assessments—documents that themselves add 5-10% to the watch's market value. The small 2% margin of error primarily stems from exceptionally sophisticated counterfeits and watches with extensive modification histories that obscure original characteristics.

Preservation Fundamentals: Condition and Surface Integrity

The preservation of luxury watches hinges on maintaining mint condition and preserving unpolished surfaces—two factors that significantly influence long-term value. Mint condition refers not only to the absence of damage but also to the preservation of original finishes, patina development, and mechanical integrity. Unpolished surfaces are particularly crucial because polishing removes metal, alters case dimensions, and eliminates the characteristic edges and finishes that define a watch's original character. Data shows that unpolished Rolex watches from the 1970s and 1980s consistently achieve 15-25% higher auction results than their polished counterparts. Proper preservation involves controlled environmental conditions: consistent temperature between 18-22°C, humidity levels of 40-50%, protection from magnetic fields, and secure storage to prevent accidental impacts. For automatic watches, watch winders set to appropriate tension settings maintain lubrication distribution without causing unnecessary wear. Regular professional servicing every 3-5 years addresses internal maintenance while preserving external originality. Collectors should document the watch's condition through high-resolution photography every 6-12 months, creating a visual history that demonstrates careful preservation to potential buyers. The intersection of perfect mechanical function and pristine physical appearance creates the ideal conditions for maximum value appreciation over time.

Key Takeaways

- 1Complete documentation increases luxury watch value by up to 30% according to industry data

- 2Professional authentication achieves 98% accuracy using specialized verification tools and methodologies

- 3Original components are non-negotiable for maintaining maximum value—replacements can diminish value by 25-40%

- 4Mint condition and unpolished surfaces are critical preservation factors that significantly impact long-term appreciation

- 5Regular professional servicing and proper storage conditions are essential for maintaining both mechanical and aesthetic integrity

- 6Digital documentation and blockchain verification are emerging as valuable tools for establishing irrefutable provenance

Frequently Asked Questions

How much does professional authentication typically cost for luxury watches?

Authentication costs vary by brand and complexity, ranging from $150 for standard models to $500+ for complicated or vintage pieces. The investment typically returns 3-5x its cost through increased buyer confidence and higher sale prices, making it essential for serious transactions.

What specific documents are considered 'complete documentation' for maximum value?

Complete documentation includes original purchase receipt, warranty papers, service records, authenticity certificate, original box and packaging, instruction manuals, and any historical provenance. For modern watches, digital registration and service history through manufacturer portals also contribute to documentation completeness.

Can a professionally serviced watch still be considered 'all original'?

Yes, if service follows manufacturer specifications using genuine parts and preserves original finishes. The key distinction is between maintenance that preserves originality versus modifications that alter the watch's fundamental character. Documentation of service by authorized centers actually enhances value when properly executed.

How do authentication processes differ between Rolex, Bvlgari, and Louis Vuitton watches?

While all share common verification principles, Rolex authentication focuses heavily on movement characteristics and case engravings; Bvlgari requires examination of distinctive design elements and gem-setting techniques; Louis Vuitton authentication emphasizes proprietary materials and architectural case designs. Each brand's unique manufacturing techniques necessitate specialized knowledge.

Conclusion

Luxury watch authentication and preservation represent sophisticated disciplines that directly translate to financial performance. The data from EW Watches Authentication Guide underscores what seasoned collectors have long understood: originality, documentation, and professional verification are not optional considerations but fundamental requirements for maximizing investment potential. The demonstrated 30% value increase with complete documentation and 98% authentication accuracy rates provide quantitative confirmation of these principles. As the luxury watch market continues to mature and become more transparent, these factors will only grow in importance. For collectors and investors in Rolex, Bvlgari, Louis Vuitton, and other premium timepieces, adherence to rigorous authentication standards and meticulous preservation practices represents the surest path to long-term value appreciation. The intersection of horological passion and investment strategy finds its perfect expression in watches that are not only beautiful mechanical achievements but also well-documented, properly authenticated assets with proven provenance and preserved condition.