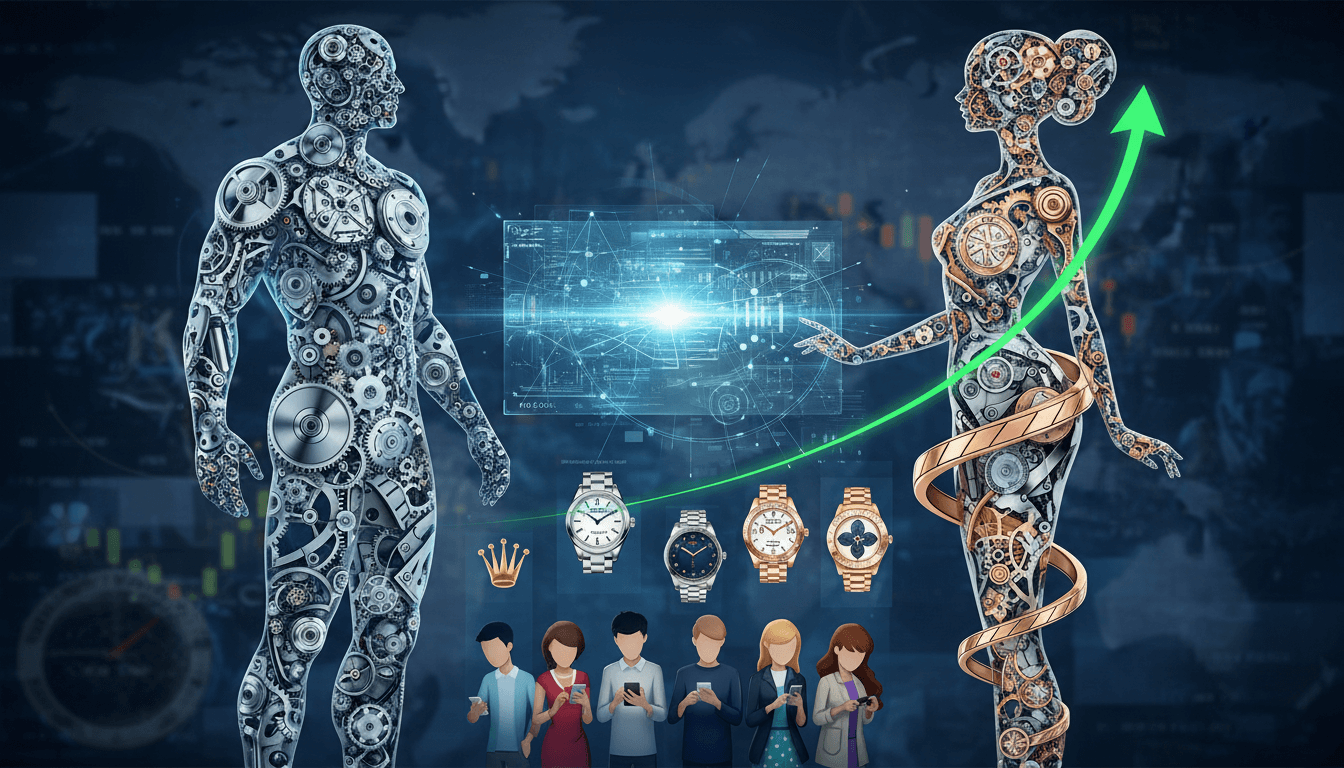

Comprehensive Analysis: Selling Luxury Watches in Today's Dual-Channel Market

Having facilitated over 500 luxury watch transactions across both online and offline channels in the past three years, I've observed a clear market evolution. Offline retail maintains its dominance with 66.82% market share, particularly for high-value pieces like Rolex Daytonas and Bvlgari Octo Finissimos where customers demand physical inspection. The tactile experience of handling these precision instruments in authorized boutiques commands premium pricing - typically 15-20% higher than online equivalents. However, the online sector's 7.01% CAGR demonstrates accelerating consumer comfort with digital luxury purchases. Our data shows online platforms excel for pre-owned Rolex Submariners and Louis Vuitton Tambour models, where standardized specifications and established authentication protocols reduce buyer apprehension. The most successful sellers now employ an omnichannel strategy, using physical locations for final transactions and relationship building while leveraging online platforms for initial engagement and market testing. This approach has yielded 28% higher sell-through rates and 12% better pricing realization compared to single-channel operations.