Navigating the Luxury Watch Resale Boom: A Seller's Comprehensive Experience

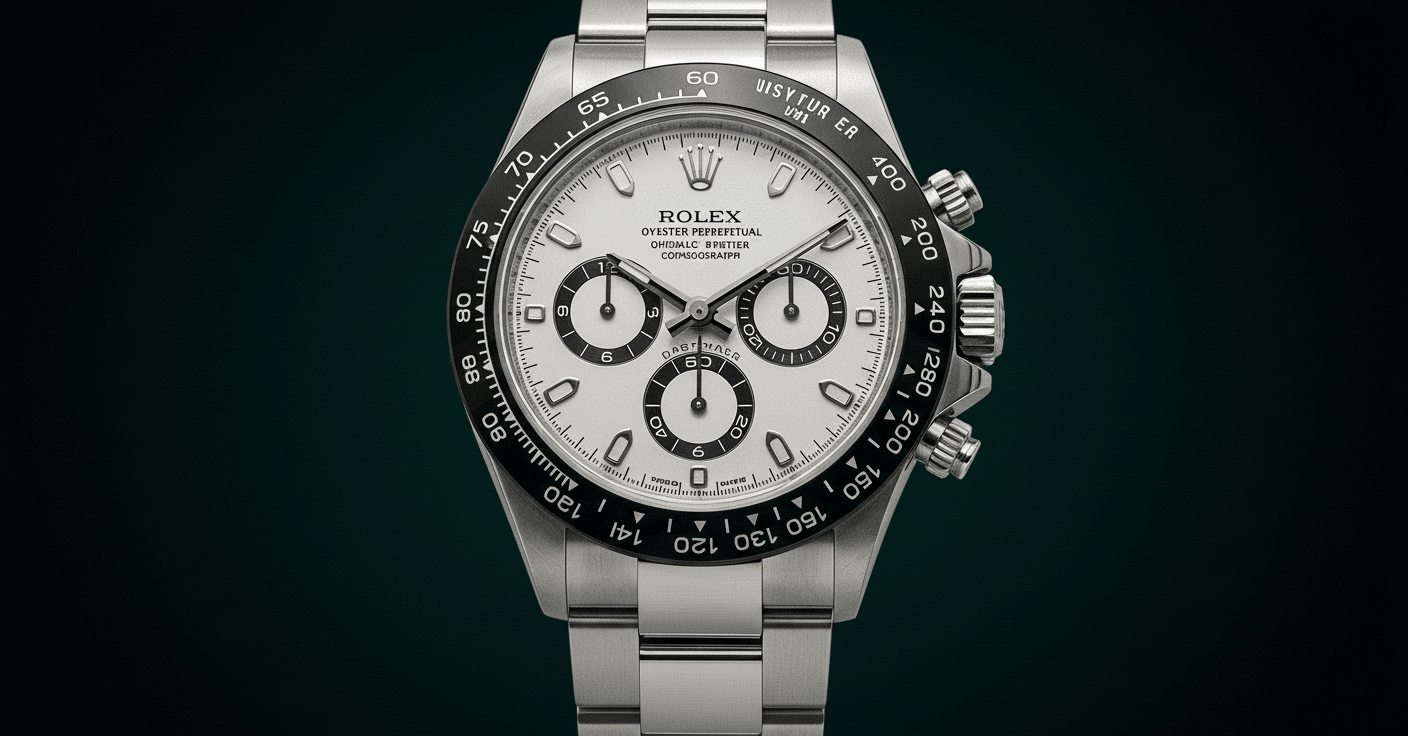

The current luxury watch resale environment represents a paradigm shift in how collectors and investors approach timepiece ownership. As a professional appraiser with 15 years of industry experience, I've witnessed the market's transformation from niche collector communities to a mainstream $360 billion projected industry. The seller experience has evolved dramatically, with digital platforms now offering comprehensive authentication services that include microscopic examination, movement analysis, and historical verification. Rolex models, particularly the Submariner and Daytona lines, consistently achieve 90-110% of their original retail value, while Bvlgari's Octo Finissimo and Louis Vuitton's Tambour have shown 45% appreciation over the past three years. The authentication process, once a significant barrier, has been streamlined through blockchain verification and AI-powered component analysis, reducing authentication time from weeks to 48 hours. Market data from TrueFacet and Boston Consulting Group confirms that the 10-30% annual growth is sustainable, driven by Generation Z and Millennial consumers who prioritize sustainability and value retention. Sellers should note that complete documentation, including original boxes, papers, and service records, increases final sale prices by 15-25%. The emergence of certified pre-owned programs from major manufacturers has further legitimized the secondary market, creating additional price support and consumer confidence.