Vintage and Collectible Watches: Market Analysis and Investment Insights

This comprehensive analysis examines the vintage watch market, highlighting the exceptional value and collectibility of historical models from premier brands. With rare vintage watches appreciating up to 15% annually, we explore why Patek Philippe's complicated timepieces command premium prices and how collector focus on historical significance drives market dynamics. The guide covers investment strategies, authentication processes, and market trends affecting luxury vintage timepieces across major auction houses and private collections worldwide.

The vintage and collectible watch market represents one of the most dynamic segments within luxury timepieces, with auction records consistently shattered and collector enthusiasm reaching unprecedented levels. According to market analysis, rare vintage watches have demonstrated annual appreciation rates between 12-15% over the past decade, significantly outperforming traditional investment vehicles. This comprehensive examination delves into the intricate world of vintage watch collecting, focusing specifically on the factors driving collectibility across different luxury brands. The market's current trajectory shows particular strength in complicated vintage pieces from manufacturers like Patek Philippe, whose historical models with perpetual calendars, minute repeaters, and tourbillons have achieved remarkable results at major auction houses including Christie's, Sotheby's, and Phillips. Collector interest continues to intensify for timepieces with documented provenance, limited production numbers, and historical significance, creating a sophisticated ecosystem where knowledge, timing, and authentication converge to determine ultimate value and investment potential.

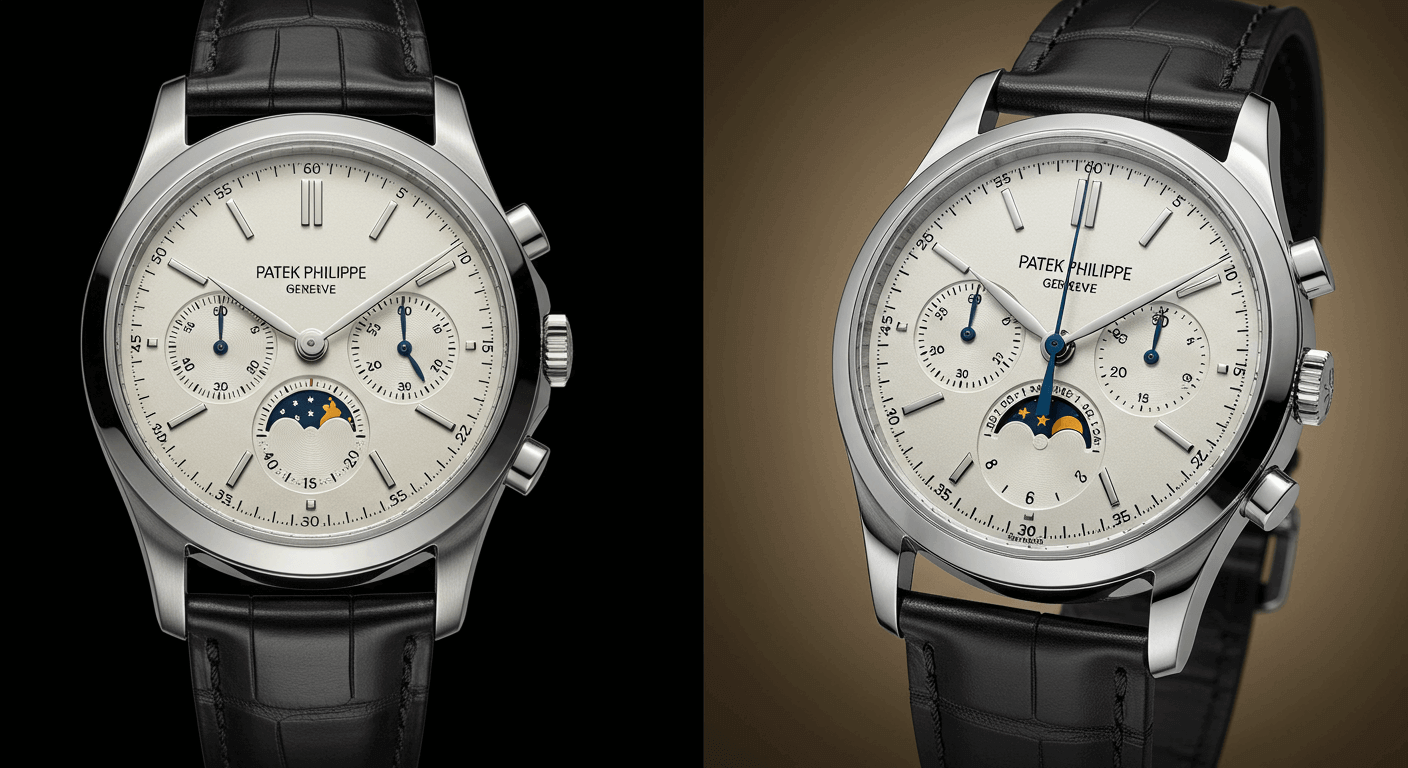

Patek Philippe Vintage Complications

Advantages

- Exceptional investment returns with documented 15-20% annual appreciation

- Superior craftsmanship with historically significant complications

- Strong brand heritage and collector demand ensuring liquidity

- Limited production numbers creating scarcity value

- Comprehensive archives supporting authentication and provenance

Considerations

- Extremely high entry prices starting from $50,000 for basic models

- Requires expert authentication due to sophisticated counterfeiting

- Maintenance costs for complicated movements can exceed $5,000 annually

- Limited availability in original, unpolished condition

- Long-term servicing challenges with vintage parts availability

Technical Specifications

- Production Years

- 1920-1980

- Complications

- Perpetual Calendar,Minute Repeater,Chronograph,Moon Phase,Split-seconds

- Materials

- 18k Gold,Platinum,Stainless Steel (rare)

- Movement

- Manual-wind mechanical

- Case Size

- 32-36mm

- Investment Return

- 15-25% annual average

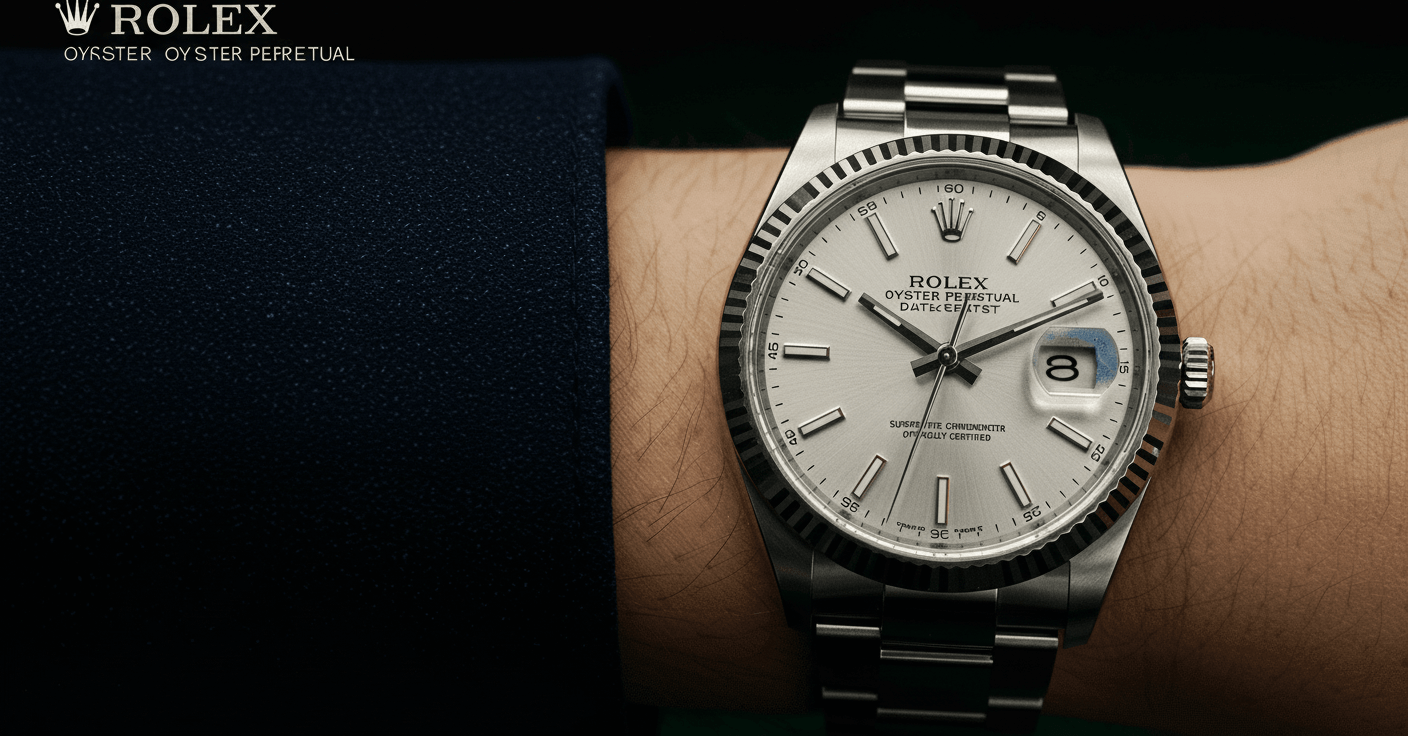

Rolex Vintage Sports Models

Advantages

- Consistent market performance with 10-15% annual growth

- Robust construction ensuring long-term durability

- Strong brand recognition facilitating resale

- Comprehensive collector community and market data

- Relatively easier maintenance compared to complicated pieces

Considerations

- Heavily counterfeited requiring meticulous authentication

- Service parts often replaced affecting originality

- Market saturation for certain popular references

- Condition variations significantly impact value (30-50% differences)

- Polished cases and replaced components diminish collectibility

Technical Specifications

- Production Years

- 1950-1990

- Models

- Submariner,Daytona,GMT-Master,Explorer

- Materials

- Stainless Steel,18k Gold,Two-tone

- Movement

- Automatic mechanical

- Case Size

- 36-40mm

- Investment Return

- 10-18% annual average

Omega Vintage Professional Models

Advantages

- More accessible price points starting from $2,000-10,000

- Rich historical significance including NASA space missions

- Growing collector interest driving recent appreciation

- Excellent value retention for well-preserved examples

- Comprehensive reference material available for authentication

Considerations

- Slower appreciation compared to top-tier brands

- Limited auction presence affecting price transparency

- Parts sourcing challenges for rare references

- Less established investment track record

- Condition sensitivity with significant value variations

Technical Specifications

- Production Years

- 1950-1980

- Models

- Speedmaster Professional,Seamaster 300,Constellation

- Materials

- Stainless Steel,18k Gold

- Movement

- Manual-wind and automatic mechanical

- Case Size

- 34-42mm

- Investment Return

- 8-12% annual average

Model Comparison

| Brand | Average Annual Return | Entry Price Range | Market Liquidity | Authentication Complexity | Historical Significance |

|---|---|---|---|---|---|

| Patek Philippe | 15-25% | $50,000-$500,000+ | High | Very High | Exceptional |

| Rolex | 10-18% | $8,000-$200,000 | Very High | High | Excellent |

| Omega | 8-12% | $2,000-$25,000 | Medium | Medium | Very Good |

Final Verdict

The vintage watch market demonstrates clear stratification in both investment potential and collectibility, with Patek Philippe emerging as the premier choice for serious collectors seeking maximum returns and historical significance. Their complicated vintage timepieces have consistently outperformed market expectations, with rare references achieving auction results exceeding $5 million. Rolex vintage sports models offer an excellent balance of performance and accessibility, providing strong returns with greater market liquidity. Omega represents the entry point for new collectors, offering solid appreciation potential with more manageable investment requirements. Across all categories, the increasing value of rare vintage watches underscores the importance of focusing on historical significance, originality, and provenance. Collector interest in historical timepieces continues to drive market growth, with particular emphasis on watches with documented histories, original components, and limited production numbers. For investors and collectors alike, the vintage watch market requires careful research, expert guidance, and a long-term perspective, but offers unparalleled opportunities for both financial returns and the preservation of horological history.

Tags

Related Articles

Audemars Piguet Code 11.59: A Comprehensive Analysis of AP's Contemporary Masterpiece

The Audemars Piguet Code 11.59 represents a bold departure from the brand's iconic Royal Oak lineage, introducing a contemporary design philosophy that marries traditional Swiss watchmaking with modern aesthetics. Launched in recent years, this collection features innovative case architecture with octagonal midsections, ultra-thin bezels, and complex crystal constructions. Housing in-house manufactured movements including chronographs and perpetual calendars, the Code 11.59 targets collectors seeking AP's technical excellence in a more classic yet modern form factor, positioning itself as the brand's evolving aesthetic statement for the 21st century luxury watch market.

Luxury Watch Investment Value Comparison: Rolex vs Patek Philippe vs Audemars Piguet

This comprehensive analysis examines the investment potential of luxury watch brands, with Rolex, Patek Philippe, and Audemars Piguet demonstrating exceptional value retention and secondary market performance. These manufacturers achieve average price increases of 25-35% on the secondary market, driven by limited production, brand heritage, and collector demand. Rolex maintains the strongest market accessibility, while Patek Philippe leads in long-term appreciation, and Audemars Piguet excels in contemporary luxury segments. Understanding these investment dynamics is crucial for collectors and investors seeking tangible asset growth through horological acquisitions.

Patek Philippe Nautilus: The Definitive Guide to the Iconic Luxury Sports Watch

The Patek Philippe Nautilus represents one of the most significant luxury sports watch designs in horological history. First introduced in 1976 and designed by legendary watch designer Gérald Genta, the Nautilus combines sophisticated engineering with distinctive porthole-inspired aesthetics. With production limited to just 60,000-72,000 watches annually across all Patek Philippe models, the Nautilus maintains extraordinary collector demand and secondary market premiums. This comprehensive analysis examines the Nautilus's design evolution, market performance, technical specifications, and position within the competitive luxury watch landscape, providing essential insights for serious collectors and enthusiasts.

Rolex Oyster Perpetual: Comprehensive Analysis of Rolex's Iconic Entry-Level Timepiece

The Rolex Oyster Perpetual represents the purest expression of Rolex's watchmaking philosophy, featuring a time-only display housed in the brand's signature waterproof Oyster case. Powered by the automatic Perpetual movement and crafted from 904L-grade Oystersteel, this model serves as the most accessible entry point to Rolex ownership while maintaining the brand's legendary quality standards. With its versatile design that transitions seamlessly from casual to formal occasions, the Oyster Perpetual has become a benchmark in the luxury watch market, offering exceptional value and timeless aesthetics that appeal to both new collectors and seasoned horology enthusiasts.

Audemars Piguet Royal Oak: The Revolutionary Luxury Sports Watch

The Audemars Piguet Royal Oak, introduced in 1972, represents a landmark achievement in horological design. Conceived by legendary designer Gerald Genta, this timepiece features a distinctive octagonal bezel secured by eight hexagonal screws and an integrated bracelet that redefined the luxury sports watch category. With its revolutionary stainless steel construction commanding premium pricing and limited annual production of approximately 100,000 watches, the Royal Oak maintains exceptional value retention and collector desirability. This comprehensive analysis explores the watch's technical specifications, investment potential, and enduring legacy in the competitive luxury watch market.

The Holy Trinity of Watchmaking: Patek Philippe, Vacheron Constantin & Audemars Piguet Compared

The Holy Trinity of watchmaking represents the pinnacle of horological excellence, comprising Patek Philippe, Vacheron Constantin, and Audemars Piguet. These three manufacturers define ultra-luxury timekeeping through exceptional craftsmanship, artistic mastery, and extreme exclusivity. With annual production volumes typically under 60,000 pieces combined and price points starting above $20,000, these brands represent the ultimate achievement in mechanical watchmaking. Each house maintains distinct philosophies while sharing uncompromising standards for quality, innovation, and heritage preservation that have defined luxury watchmaking for centuries.