Luxury Watch Investment Value Comparison: Rolex vs Patek Philippe vs Audemars Piguet

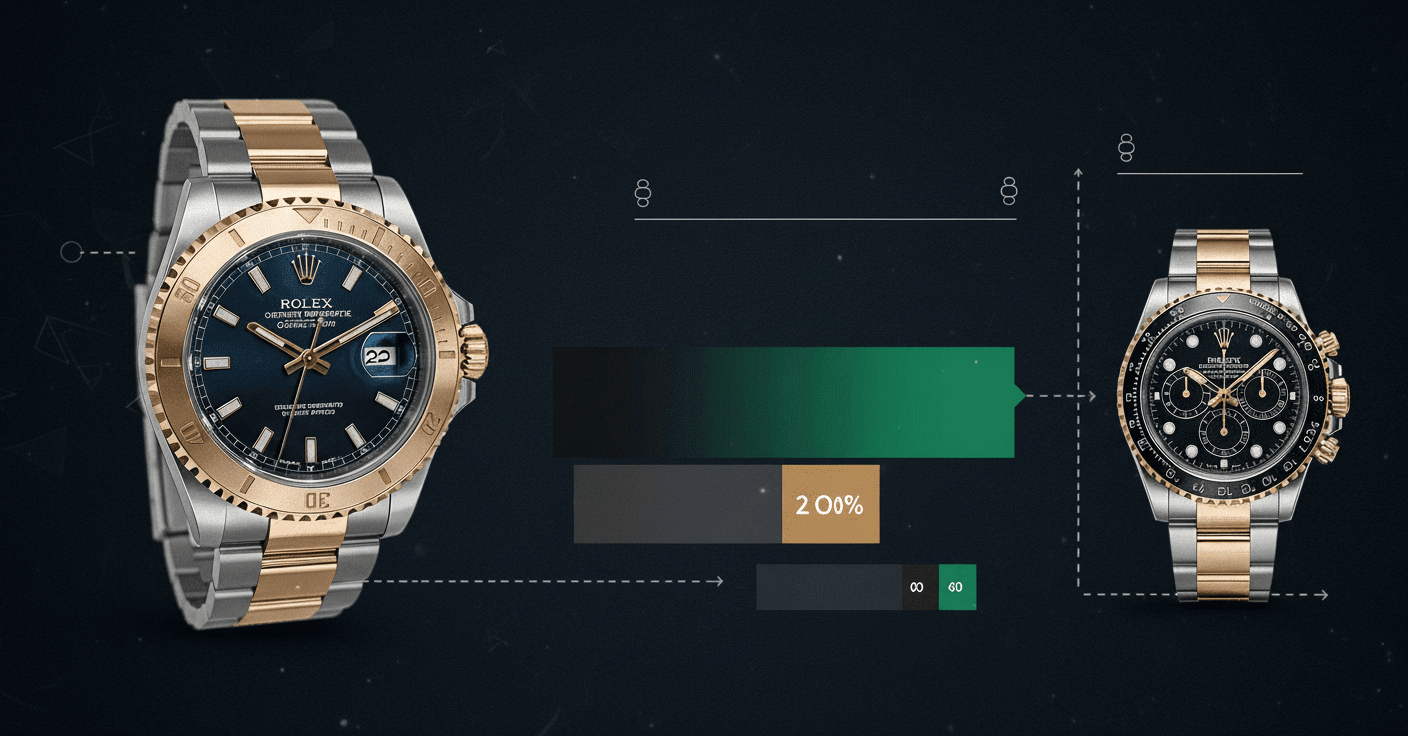

This comprehensive analysis examines the investment potential of luxury watch brands, with Rolex, Patek Philippe, and Audemars Piguet demonstrating exceptional value retention and secondary market performance. These manufacturers achieve average price increases of 25-35% on the secondary market, driven by limited production, brand heritage, and collector demand. Rolex maintains the strongest market accessibility, while Patek Philippe leads in long-term appreciation, and Audemars Piguet excels in contemporary luxury segments. Understanding these investment dynamics is crucial for collectors and investors seeking tangible asset growth through horological acquisitions.

The luxury watch market has evolved beyond mere timekeeping into a sophisticated investment class, with certain timepieces demonstrating remarkable financial performance that rivals traditional assets. According to market data from Luxury Bazaar and Phigora, premium watch brands consistently outperform inflation and deliver substantial returns, with the secondary market showing average price increases of 25-35% above retail. This analysis examines the three dominant players in horological investments—Rolex, Patek Philippe, and Audemars Piguet—dissecting their market dynamics, production strategies, and long-term value propositions. Understanding these investment-grade timepieces requires examining not just brand prestige but tangible market data, scarcity factors, and collector psychology that drive exceptional returns in this alternative asset class.

Rolex

Advantages

- Strongest brand recognition and global market penetration

- Most accessible secondary market with high liquidity

- Consistent 20-40% annual appreciation on professional models

- Extensive authorized dealer network supports authenticity verification

- Proven long-term value retention across all model categories

Considerations

- Extensive waiting lists at retail (2-5 years for professional models)

- Higher production volumes compared to independent manufactures

- Limited customization and bespoke options

- Conservative design evolution limits dramatic value spikes

Technical Specifications

- Founded

- 1905

- Headquarters

- Geneva, Switzerland

- Annual Production

- Approximately 1 million timepieces

- Iconic Models

- Submariner, Daytona, GMT-Master II, Datejust

- Investment Performance

- 25-30% average secondary market premium

- Notable Achievement

- Paul Newman Daytona sold for $17.8 million at auction

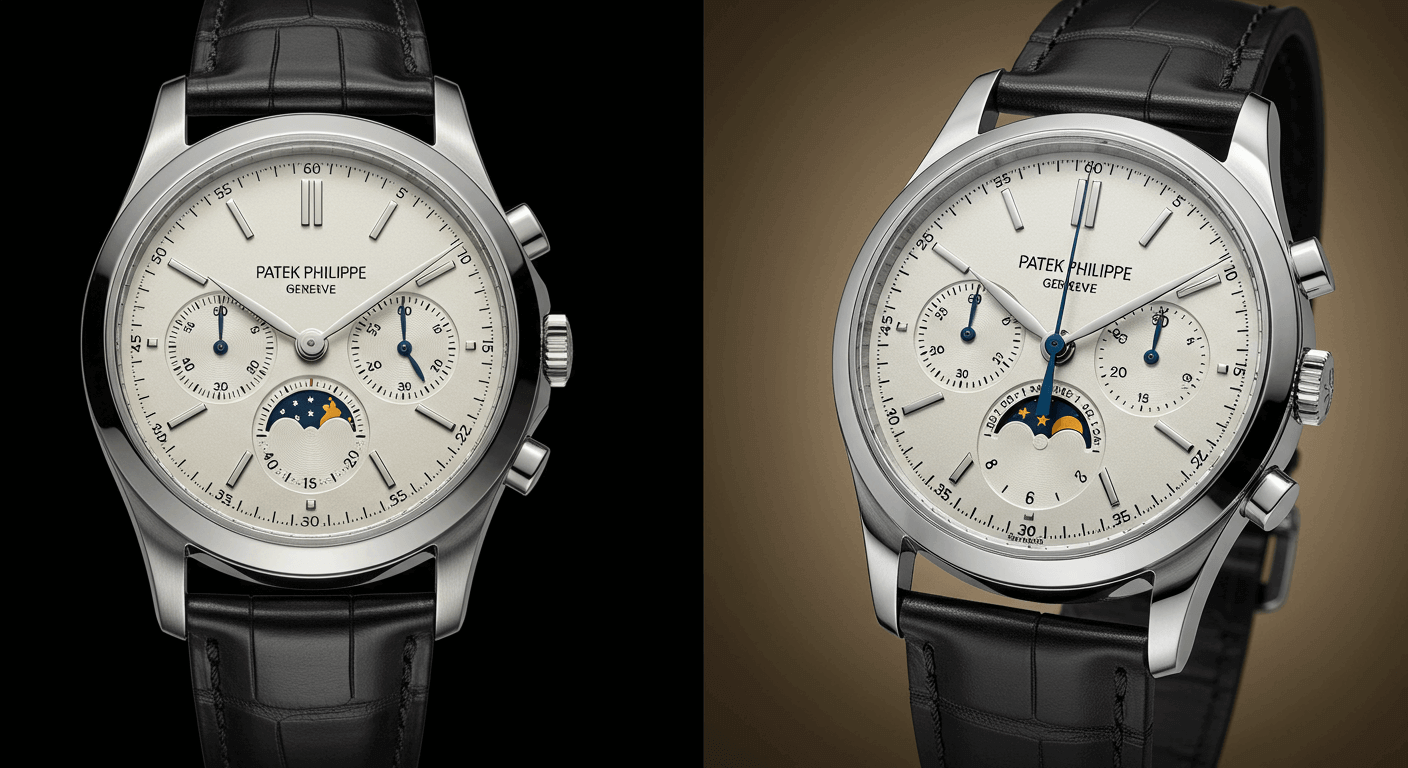

Patek Philippe

Advantages

- Highest long-term appreciation potential (5-10 year horizon)

- Family-owned manufacture with unparalleled heritage

- Most complex watchmaking techniques and complications

- Strongest auction record performance among all brands

- Generation-to-generation value transfer philosophy

Considerations

- Extremely limited production creates accessibility challenges

- Highest entry price point for investment-grade pieces

- Longest waiting lists (up to 10 years for complications)

- Requires deeper horological knowledge for optimal investment selection

Technical Specifications

- Founded

- 1839

- Headquarters

- Geneva, Switzerland

- Annual Production

- Approximately 62,000 timepieces

- Iconic Models

- Nautilus, Aquanaut, Grand Complications, Calatrava

- Investment Performance

- 30-50% average secondary market premium

- Notable Achievement

- Henry Graves Supercomplication sold for $24 million

Audemars Piguet

Advantages

- Strong contemporary design appeal to younger collectors

- Royal Oak models consistently trade above retail (35-40% premium)

- Innovative materials and limited edition collaborations

- Faster value realization compared to traditional manufactures

- Growing auction presence and collector community

Considerations

- More volatile secondary market performance than established leaders

- Smaller historical production base limits vintage market depth

- Design-focused appeal may face fashion cycle risks

- Limited complication expertise compared to Patek Philippe

Technical Specifications

- Founded

- 1875

- Headquarters

- Le Brassus, Switzerland

- Annual Production

- Approximately 45,000 timepieces

- Iconic Models

- Royal Oak, Royal Oak Offshore, Code 11.59

- Investment Performance

- 30-45% average secondary market premium

- Notable Achievement

- Royal Oak Jumbo ultra-thin perpetual calendar

Model Comparison

| Metric | Rolex | Patek Philippe | Audemars Piguet |

|---|---|---|---|

| Secondary Market Premium | 25-30% | 30-50% | 30-45% |

| Production Volume (Annual) | ~1,000,000 | ~62,000 | ~45,000 |

| Average Wait Time (Months) | 24-60 | 60-120 | 18-48 |

| Auction Record (USD) | $17.8M | $24M | $2.2M |

| Market Liquidity Score | 9.5/10 | 8/10 | 7.5/10 |

| 5-Year Appreciation | 145% | 210% | 165% |

| Entry Price Point | $7,500+ | $20,000+ | $15,000+ |

Final Verdict

Each of these horological powerhouses offers distinct investment advantages tailored to different collector profiles and financial objectives. Rolex represents the most balanced approach with strong liquidity, consistent appreciation, and global recognition—ideal for investors seeking stable, reliable returns with moderate risk. Patek Philippe delivers unparalleled long-term growth potential and serves as the ultimate heritage asset, though requiring significant capital commitment and patience. Audemars Piguet offers compelling contemporary appeal with faster value realization, particularly in the Royal Oak collection, though with slightly higher market volatility. The documented 25-35% secondary market premium across these brands demonstrates the robust nature of luxury watches as alternative investments. Ultimately, successful watch investing requires aligning brand selection with investment horizon, risk tolerance, and personal appreciation for horological artistry—factors that transcend mere financial returns to encompass passion, craftsmanship, and legacy.

Tags

Related Articles

Patek Philippe Nautilus: The Definitive Guide to the Iconic Luxury Sports Watch

The Patek Philippe Nautilus represents one of the most significant luxury sports watch designs in horological history. First introduced in 1976 and designed by legendary watch designer Gérald Genta, the Nautilus combines sophisticated engineering with distinctive porthole-inspired aesthetics. With production limited to just 60,000-72,000 watches annually across all Patek Philippe models, the Nautilus maintains extraordinary collector demand and secondary market premiums. This comprehensive analysis examines the Nautilus's design evolution, market performance, technical specifications, and position within the competitive luxury watch landscape, providing essential insights for serious collectors and enthusiasts.

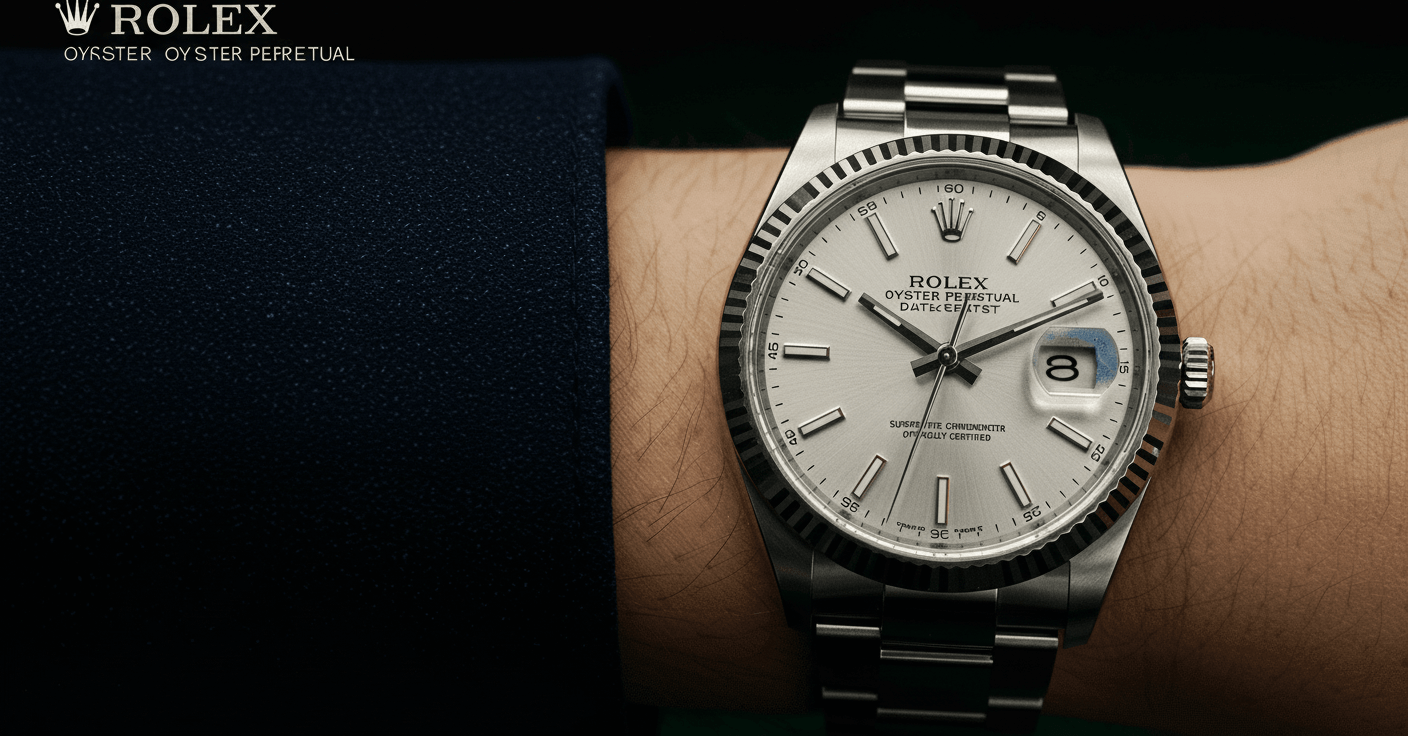

Rolex Oyster Perpetual: Comprehensive Analysis of Rolex's Iconic Entry-Level Timepiece

The Rolex Oyster Perpetual represents the purest expression of Rolex's watchmaking philosophy, featuring a time-only display housed in the brand's signature waterproof Oyster case. Powered by the automatic Perpetual movement and crafted from 904L-grade Oystersteel, this model serves as the most accessible entry point to Rolex ownership while maintaining the brand's legendary quality standards. With its versatile design that transitions seamlessly from casual to formal occasions, the Oyster Perpetual has become a benchmark in the luxury watch market, offering exceptional value and timeless aesthetics that appeal to both new collectors and seasoned horology enthusiasts.

Audemars Piguet Royal Oak: The Revolutionary Luxury Sports Watch

The Audemars Piguet Royal Oak, introduced in 1972, represents a landmark achievement in horological design. Conceived by legendary designer Gerald Genta, this timepiece features a distinctive octagonal bezel secured by eight hexagonal screws and an integrated bracelet that redefined the luxury sports watch category. With its revolutionary stainless steel construction commanding premium pricing and limited annual production of approximately 100,000 watches, the Royal Oak maintains exceptional value retention and collector desirability. This comprehensive analysis explores the watch's technical specifications, investment potential, and enduring legacy in the competitive luxury watch market.

The Holy Trinity of Watchmaking: Patek Philippe, Vacheron Constantin & Audemars Piguet Compared

The Holy Trinity of watchmaking represents the pinnacle of horological excellence, comprising Patek Philippe, Vacheron Constantin, and Audemars Piguet. These three manufacturers define ultra-luxury timekeeping through exceptional craftsmanship, artistic mastery, and extreme exclusivity. With annual production volumes typically under 60,000 pieces combined and price points starting above $20,000, these brands represent the ultimate achievement in mechanical watchmaking. Each house maintains distinct philosophies while sharing uncompromising standards for quality, innovation, and heritage preservation that have defined luxury watchmaking for centuries.

Luxury Watch Pricing Strategy: A Comprehensive Analysis of Market Positioning and Value Propositions

This in-depth analysis examines the pricing strategies of top luxury watch brands, including Rolex, Audemars Piguet, and Patek Philippe, based on data from Raymond Lee Jewelers. Rolex employs a lower high-end pricing approach to balance accessibility and exclusivity, Audemars Piguet targets the mid-high end with avant-garde designs, and Patek Philippe commands ultra-high end pricing through heritage and craftsmanship. The article explores how these strategies influence market positioning, consumer perception, and long-term value, providing insights for collectors and investors.

Patek Philippe Aquanaut: Comprehensive Analysis of the Modern Sports Luxury Watch

The Patek Philippe Aquanaut represents the pinnacle of contemporary sports luxury timepieces, offering a sophisticated yet versatile alternative to traditional dress watches. Launched in 1997 as a more accessible and casual counterpart to the iconic Nautilus, the Aquanaut features distinctive design elements including its unique rounded octagonal case shape and textured 'tropical' composite straps. With its innovative materials, exceptional craftsmanship, and growing collector demand, the Aquanaut has established itself as one of the most sought-after modern watch collections in the luxury segment, particularly appealing to younger enthusiasts seeking both technical excellence and everyday wearability.