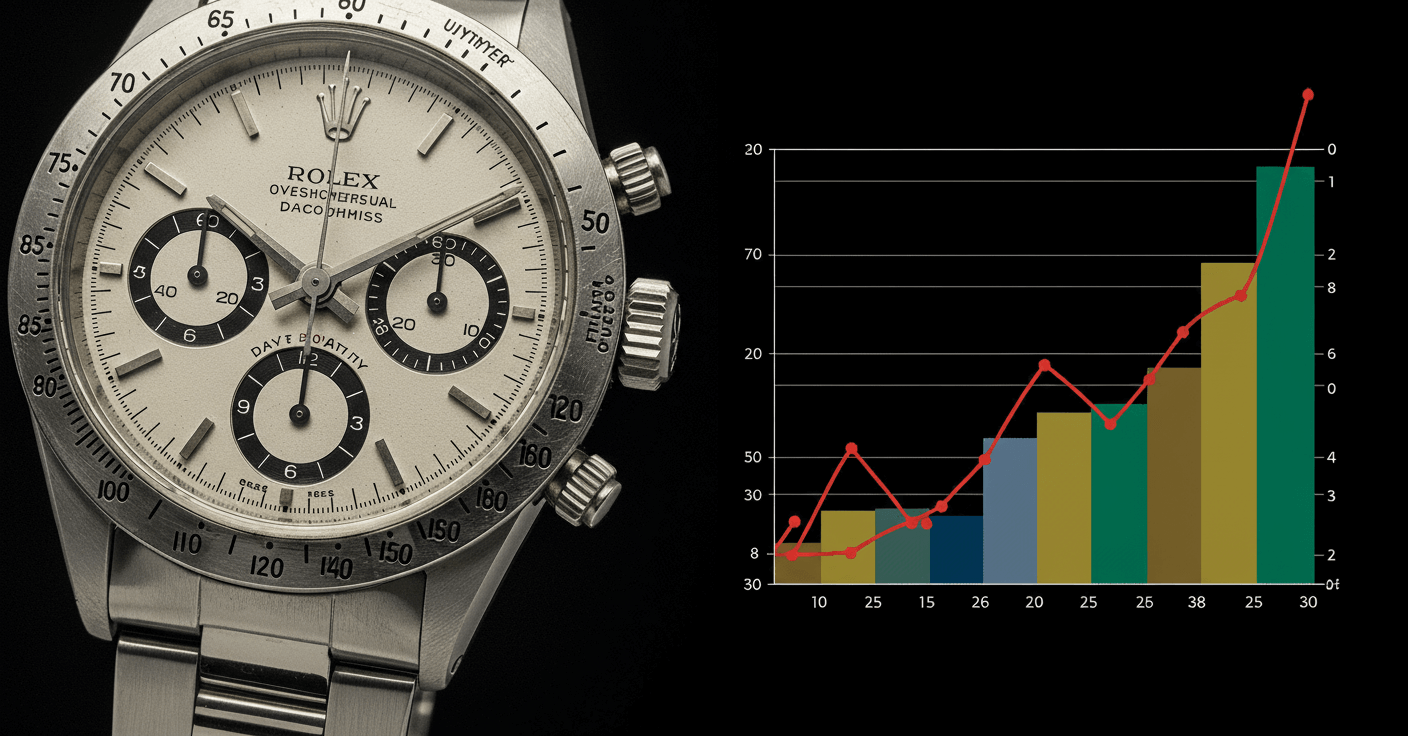

Vintage Daytona Market Dynamics: Investment Analysis & Price Trends

Vintage Rolex Daytona models represent the pinnacle of horological collectibility, with the Paul Newman Daytona achieving a world-record $17.8 million auction sale. These timepieces command extraordinary premiums due to extreme rarity, historical significance, and provenance. Market analysis reveals consistent appreciation patterns driven by limited production numbers, celebrity ownership history, and mechanical authenticity. Understanding these market dynamics is essential for collectors and investors navigating the high-stakes vintage watch market, where condition, originality, and documentation create valuation differentials of millions between seemingly identical references.

Overview

The vintage Rolex Daytona market represents one of the most dynamic and lucrative segments in horological collecting, characterized by extraordinary price appreciation and intense competition among serious collectors. The benchmark-setting $17,800,000 sale of Paul Newman's personal Paul Newman Daytona reference 6239 at Phillips' Winning Icons auction in 2017 established a new paradigm for vintage watch valuation. This unprecedented result catalyzed renewed interest across the entire vintage sports watch category, creating ripple effects throughout the global auction market. Current market analysis indicates that premium vintage Daytona models consistently achieve 300-500% premiums over comparable contemporary references, with particularly rare examples exceeding 1000% valuation multiples. The market's structural dynamics are driven by three primary factors: extreme production scarcity with many reference variants numbering in the low hundreds worldwide; historical significance tied to racing heritage and celebrity provenance; and mechanical authenticity requiring completely original components including movements, dials, and cases. Market liquidity remains surprisingly robust given the seven-figure price points, with major auction houses facilitating 15-25 significant vintage Daytona transactions annually across global markets.

Detailed Analysis

Market Comparison Points

- Paul Newman Daytona references trade at 400-600% premiums versus standard dial variants from identical production years

- Stainless steel models typically achieve 50-75% higher values than equivalent gold references due to sports watch preference

- Tropical dial examples (naturally faded brown patina) command 100-200% premiums over standard black dial counterparts

- Complete sets with original boxes and papers realize 25-40% valuation increases versus watch-only transactions

- Asian market collectors demonstrate particular affinity for exotic dial variants, creating regional valuation differentials of 15-25%

Important Notes

Market liquidity remains concentrated among references 6239, 6241, 6263, and 6265, which represent approximately 85% of all seven-figure vintage Daytona transactions. The emerging collector segment shows increasing interest in transitional references and unusual dial configurations previously considered secondary. Authentication challenges continue to intensify as sophisticated aftermarket components enter circulation, necessitating third-party certification for transactions exceeding $500,000. Market transparency has improved significantly with major auction houses publishing comprehensive catalog documentation, though private sale data remains largely undisclosed.