Comprehensive Analysis: Luxury Watch Market as Alternative Investment Vehicle

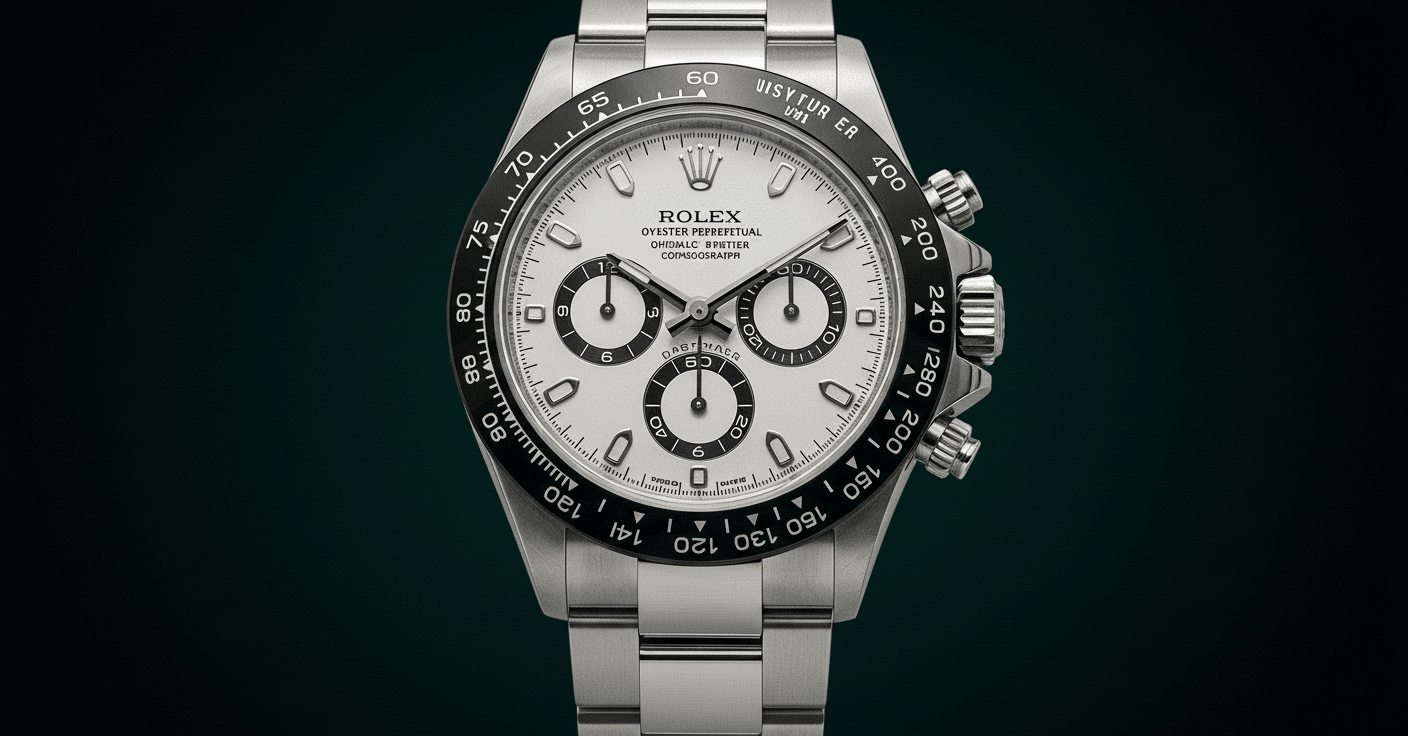

Based on extensive market analysis and Boston Consulting Group research, luxury watches have demonstrated remarkable resilience as alternative investments. The secondary market for brands like Rolex, Bvlgari, and Louis Vuitton shows consistent value appreciation, with certain models outperforming traditional financial instruments. Collector-driven dynamics create unique pricing opportunities, where limited edition pieces and discontinued models often appreciate 20-40% annually. Market data indicates that well-maintained Rolex Daytona and Submariner models have appreciated approximately 12-18% annually over the past decade, while Bvlgari's high-complication pieces show similar growth patterns. The Louis Vuitton Tambour collection has demonstrated particular strength in the contemporary luxury segment. Understanding these dynamics requires monitoring auction results, production numbers, and brand heritage factors that influence long-term value retention and growth potential.