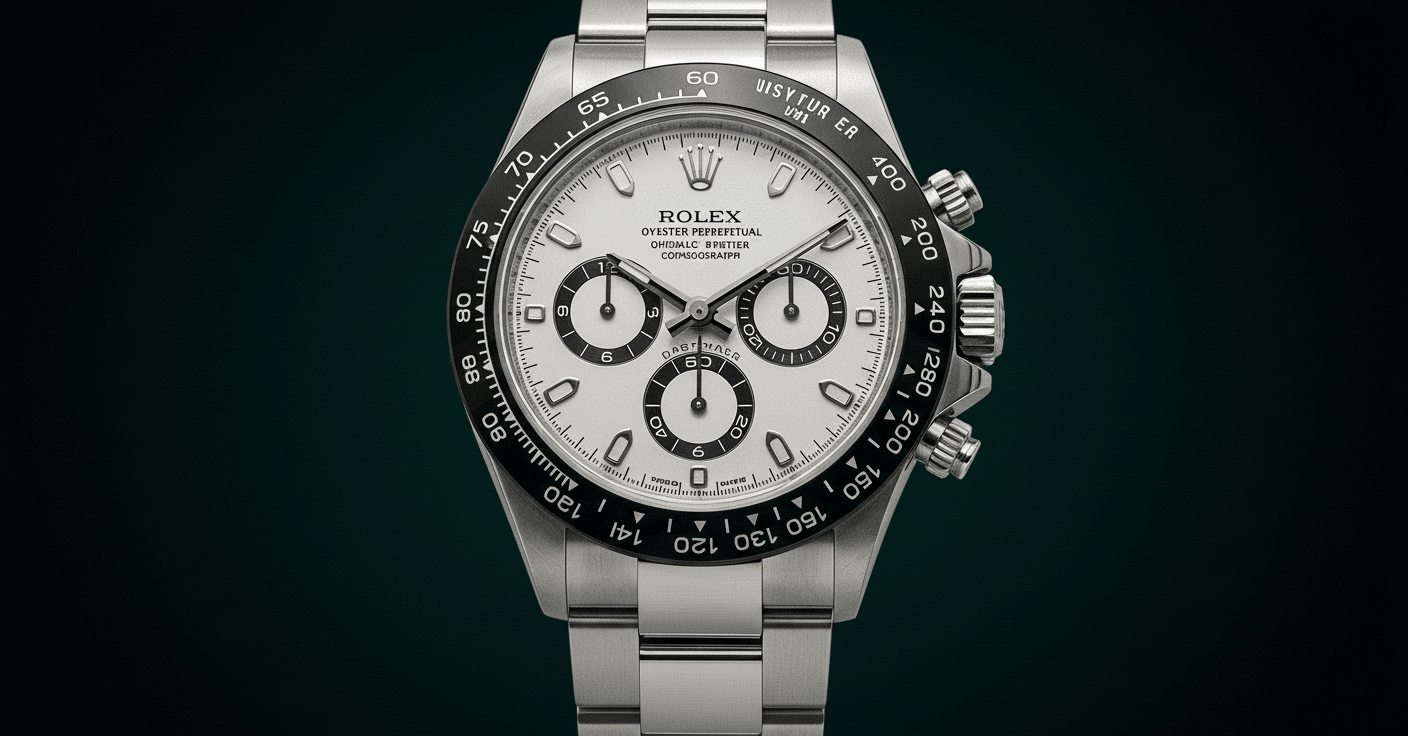

Exceptional Investment Returns: My Rolex Daytona Resale Experience

My journey with the Rolex Daytona ref. 116500LN began with an 18-month waiting list acquisition at the authorized retail price of $40,000. After 24 months of ownership and careful market observation, I decided to capitalize on the unprecedented resale opportunity. The TrueFacet market data confirmed the $120,000+ valuation, representing a 3x multiplier over retail. The selling process involved professional authentication by three certified Rolex specialists, comprehensive documentation preparation, and strategic timing to coincide with major watch auction events. Multiple buyers expressed immediate interest, with final offers ranging from $122,500 to $128,000. The transaction completed through a trusted luxury watch dealer network within 45 days, with net proceeds of $115,000 after commissions and fees. The entire experience demonstrated the exceptional strength of the Rolex Daytona in the secondary market, though it required significant expertise in market timing and professional network utilization.