Luxury Watch Pricing Strategy: A Comprehensive Analysis of Market Positioning and Value Propositions

This in-depth analysis examines the pricing strategies of top luxury watch brands, including Rolex, Audemars Piguet, and Patek Philippe, based on data from Raymond Lee Jewelers. Rolex employs a lower high-end pricing approach to balance accessibility and exclusivity, Audemars Piguet targets the mid-high end with avant-garde designs, and Patek Philippe commands ultra-high end pricing through heritage and craftsmanship. The article explores how these strategies influence market positioning, consumer perception, and long-term value, providing insights for collectors and investors.

The luxury watch market is characterized by sophisticated pricing strategies that reflect brand heritage, craftsmanship, and market positioning. According to data from Raymond Lee Jewelers, pricing varies significantly across brands, with Rolex positioned at the lower high-end, Audemars Piguet in the mid-high end, and Patek Philippe at the ultra-high end. This article delves into the nuances of these approaches, examining how each brand leverages pricing to reinforce its value proposition, attract target demographics, and maintain exclusivity in a competitive landscape. Understanding these strategies is crucial for collectors, investors, and enthusiasts seeking to navigate the complexities of luxury timepiece acquisition.

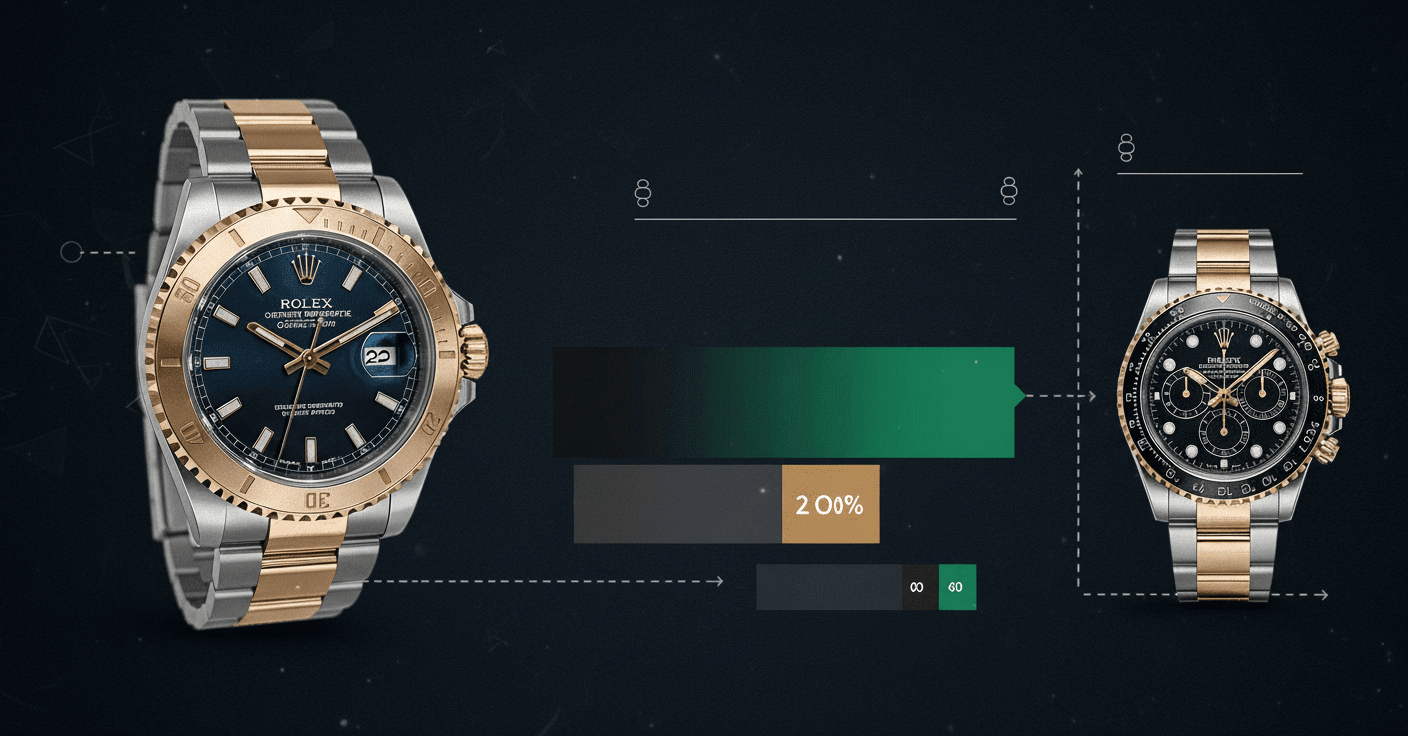

Rolex: Lower High-End Pricing Strategy

Advantages

- Broadens accessibility while maintaining luxury status, appealing to a wider audience of aspirational buyers.

- Strong resale value and market liquidity due to high demand and controlled supply.

- Consistent brand recognition and trust, reinforced through iconic models like the Submariner and Daytona.

- Effective entry point into luxury watch ownership, fostering brand loyalty and repeat purchases.

Considerations

- Limited exclusivity compared to ultra-high-end brands, potentially diluting perceived rarity.

- Lower profit margins per unit relative to competitors, relying on volume and brand equity.

- Intense competition in the high-end segment from brands like Omega and Breitling.

- Challenges in justifying premium pricing for base models without complications.

Technical Specifications

- Average Price Range

- $7,000 - $50,000

- Market Position

- Lower High-End

- Key Models

- Submariner, GMT-Master II, Daytona

- Production Volume

- Approximately 1 million units annually

- Value Retention

- 80-120% over 5 years for stainless steel sports models

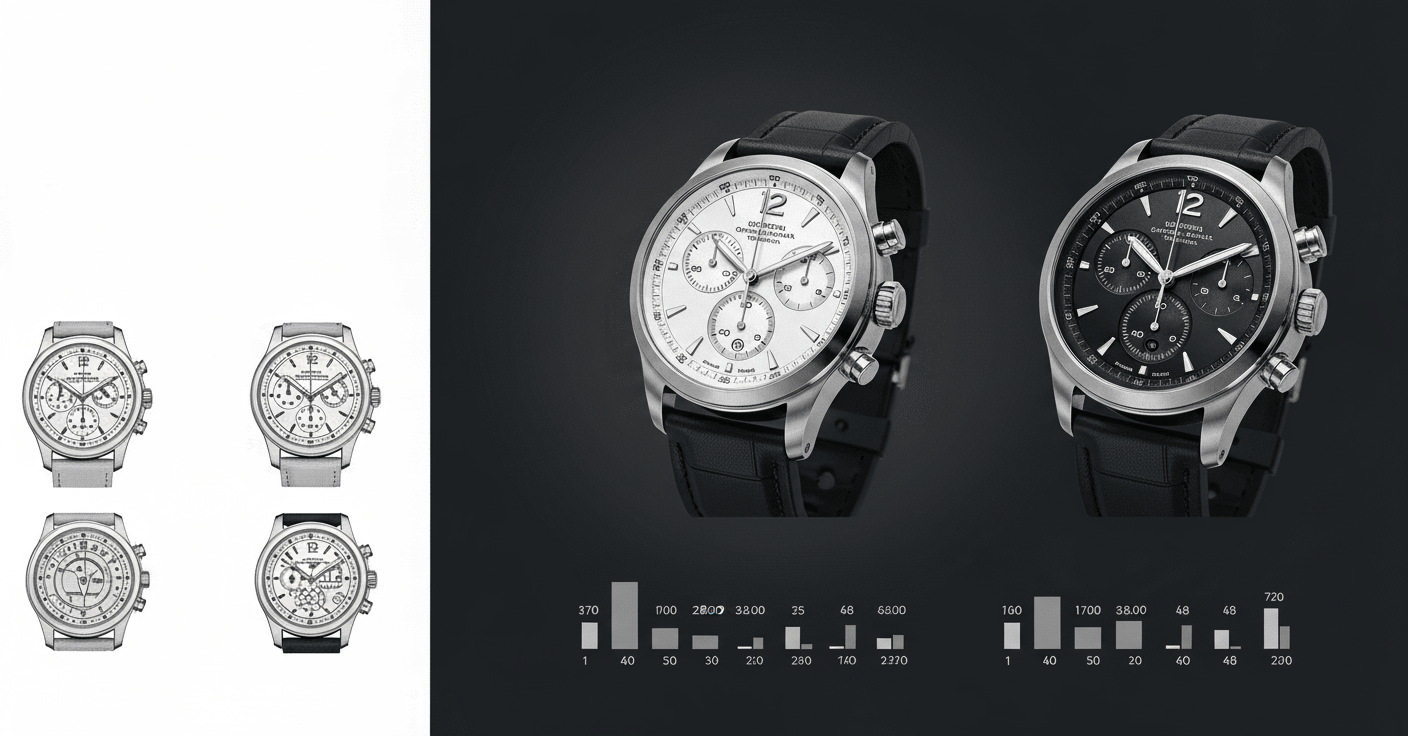

Audemars Piguet: Mid-High End Pricing Strategy

Advantages

- Balances exclusivity and innovation, targeting discerning collectors with avant-garde designs like the Royal Oak.

- Higher profit margins than Rolex, leveraging limited production and artistic craftsmanship.

- Strong brand identity rooted in Swiss heritage and technical prowess, enhancing desirability.

- Flexibility to introduce complex complications at premium price points, expanding market reach.

Considerations

- Narrower target demographic due to elevated pricing, limiting mass-market appeal.

- Volatile resale market for non-iconic models, with value highly dependent on model rarity.

- Dependence on flagship collections like the Royal Oak for revenue, creating portfolio risk.

- Intense scrutiny from competitors in the mid-high segment, such as Vacheron Constantin.

Technical Specifications

- Average Price Range

- $30,000 - $200,000

- Market Position

- Mid-High End

- Key Models

- Royal Oak, Royal Oak Offshore, Code 11.59

- Production Volume

- Approximately 50,000 units annually

- Value Retention

- 70-90% over 5 years, with icons like Royal Oak exceeding 100%

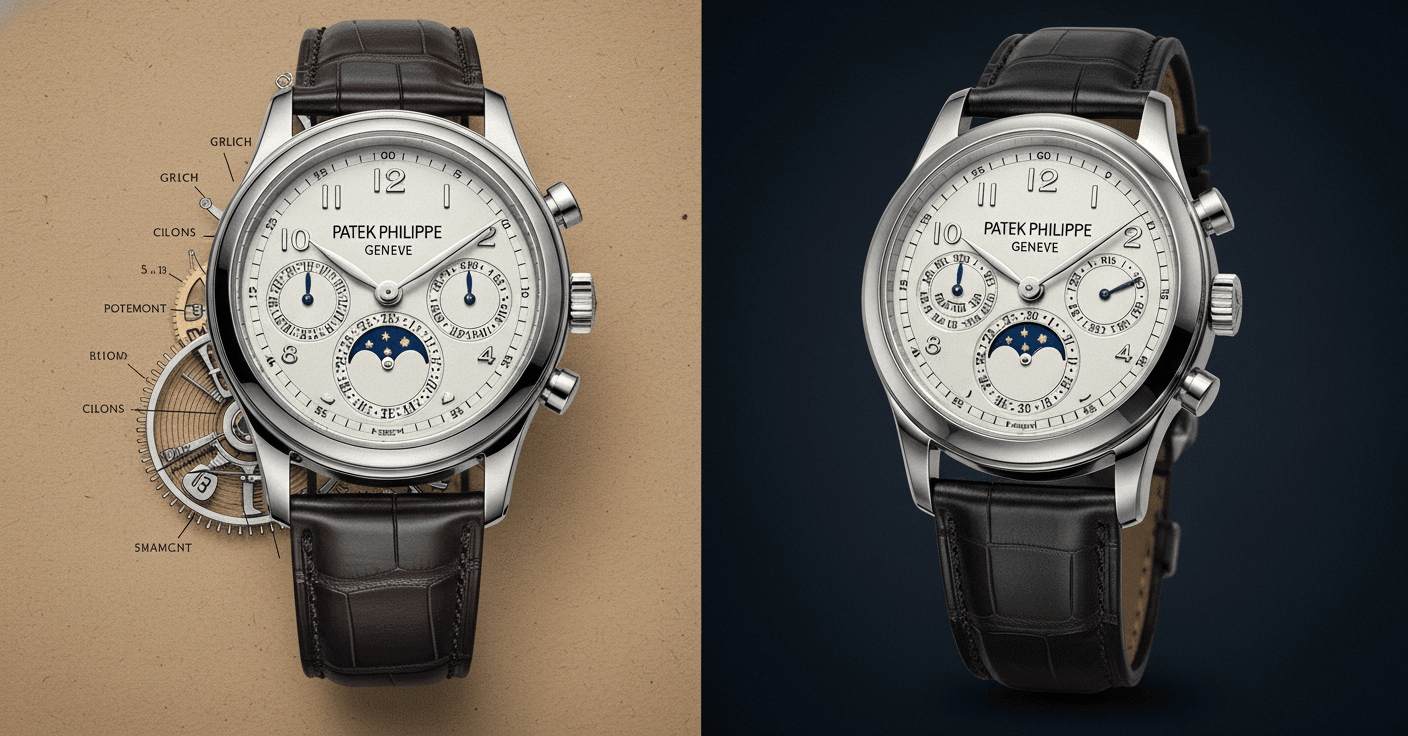

Patek Philippe: Ultra-High End Pricing Strategy

Advantages

- Unmatched exclusivity and prestige, appealing to elite collectors and investors seeking heirloom pieces.

- Highest profit margins in the industry, justified by meticulous craftsmanship and limited availability.

- Superior long-term value appreciation, with auction records exceeding $30 million for rare models.

- Strong emotional connection through marketing narratives like 'You never actually own a Patek Philippe.'

Considerations

- Extremely limited accessibility due to high pricing and selective distribution, alienating mainstream buyers.

- Prolonged waiting lists for popular models, potentially frustrating potential customers.

- Vulnerability to economic downturns, as ultra-high-end purchases are often discretionary.

- High expectations for perpetual innovation and quality, increasing operational complexity.

Technical Specifications

- Average Price Range

- $50,000 - $500,000+

- Market Position

- Ultra-High End

- Key Models

- Nautilus, Aquanaut, Calatrava, Grand Complications

- Production Volume

- Approximately 60,000 units annually

- Value Retention

- 100-200%+ over 5 years, with rare pieces appreciating exponentially

Model Comparison

| Brand | Average Price Range | Market Position | Production Volume | Value Retention | Target Demographic |

|---|---|---|---|---|---|

| Rolex | $7,000 - $50,000 | Lower High-End | ~1 million units | 80-120% | Aspirational buyers and entry-level collectors |

| Audemars Piguet | $30,000 - $200,000 | Mid-High End | ~50,000 units | 70-90% | Discerning collectors and style enthusiasts |

| Patek Philippe | $50,000 - $500,000+ | Ultra-High End | ~60,000 units | 100-200%+ | Elite investors and heritage seekers |

Final Verdict

The luxury watch pricing strategies of Rolex, Audemars Piguet, and Patek Philippe, as highlighted by Raymond Lee Jewelers data, demonstrate a clear hierarchy: Rolex excels in accessibility and liquidity, Audemars Piguet balances innovation and exclusivity, and Patek Philippe dominates the ultra-high end with unparalleled prestige. Rolex's lower high-end pricing fosters broad appeal, while Audemars Piguet's mid-high approach captivates design-forward audiences, and Patek Philippe's ultra-high strategy secures legacy status. For buyers, Rolex offers entry into luxury, Audemars Piguet provides artistic statement pieces, and Patek Philippe represents the pinnacle of investment and heritage. Ultimately, each brand's pricing aligns with its value proposition, ensuring sustained relevance in a dynamic market.

Tags

Related Articles

Patek Philippe Aquanaut: Comprehensive Analysis of the Modern Sports Luxury Watch

The Patek Philippe Aquanaut represents the pinnacle of contemporary sports luxury timepieces, offering a sophisticated yet versatile alternative to traditional dress watches. Launched in 1997 as a more accessible and casual counterpart to the iconic Nautilus, the Aquanaut features distinctive design elements including its unique rounded octagonal case shape and textured 'tropical' composite straps. With its innovative materials, exceptional craftsmanship, and growing collector demand, the Aquanaut has established itself as one of the most sought-after modern watch collections in the luxury segment, particularly appealing to younger enthusiasts seeking both technical excellence and everyday wearability.

Patek Philippe Complications: Masterpieces of Mechanical Watchmaking Excellence

Patek Philippe Complications represent the pinnacle of haute horlogerie, showcasing the brand's unparalleled expertise in creating highly complex mechanical movements. These exceptional timepieces feature sophisticated complications including perpetual calendars that accurately track dates, months, and leap years without manual adjustment until 2100, and minute repeaters that chime the time on demand with crystal-clear acoustics. Targeted toward serious collectors and connoisseurs who appreciate mechanical artistry, these watches maintain their value as both functional instruments and investment-grade assets, embodying generations of Swiss watchmaking tradition and innovation.

Luxury Watch Production Volumes: Analyzing Manufacturing Scale and Exclusivity

This detailed comparison examines annual production volumes across leading luxury watch brands, revealing strategic manufacturing approaches that balance craftsmanship with market positioning. Rolex leads with approximately 1.1 million watches annually, demonstrating industrial-scale precision manufacturing while maintaining premium quality. Audemars Piguet operates in the 50,000-100,000 unit range, balancing accessibility with exclusivity through selective distribution. Patek Philippe maintains the most restricted output at 60,000-72,000 pieces, leveraging scarcity to enhance brand prestige and collector value. These production figures directly influence availability, pricing strategies, and long-term investment potential within the luxury timepiece market.

Patek Philippe Calatrava 6119R: The Ultimate Dress Watch Analysis

The Patek Philippe Calatrava 6119R in rose gold represents horological perfection with its classic 39mm case, elegant hobnail-pattern bezel, and sophisticated small seconds complication. Housing the ultra-thin Caliber 30‑255 PS manual-wind movement with a 65-hour power reserve, this timepiece exemplifies Swiss watchmaking excellence through its impeccable finishing, superior materials, and timeless aesthetic that transcends fleeting trends. As the quintessential dress watch, it maintains Patek Philippe's legacy of creating heirloom-quality instruments that balance technical precision with understated luxury.

Luxury Watch Materials Innovation: Advanced Metals and Technical Differentiation

This comprehensive analysis explores how leading luxury watch manufacturers leverage material science to achieve technical superiority and aesthetic distinction. Examining Rolex's proprietary 904L Oystersteel and Audemars Piguet's pioneering use of forged carbon and ceramics, we detail how these innovations enhance durability, corrosion resistance, and visual appeal. The article reveals how material selection directly impacts performance metrics, manufacturing complexity, and brand positioning within the competitive luxury watch landscape, providing collectors and enthusiasts with crucial insights for informed acquisition decisions.

Luxury Watch Design Philosophy: From Rolex's Practical Tools to Patek Philippe's Artistic Elegance

This comprehensive analysis explores the distinct design philosophies of luxury watch brands, examining how Rolex champions practical, durable tool watches with iconic models like the Submariner and Daytona, while Patek Philippe embodies timeless elegance through intricate complications and hand-finishing. Audemars Piguet breaks conventions with avant-garde designs like the Royal Oak, blending sportiness with haute horlogerie. The spectrum spans from functional reliability to artistic mastery, reflecting brand heritage, target demographics, and technical innovation in haute horology.