Luxury Watch Investment Fundamentals: Maximizing Returns in High-End Timepieces

Luxury watches have evolved into a compelling alternative asset class, offering market-beating returns and portfolio diversification. This comprehensive guide explores the core principles of investing in high-end timepieces, focusing on brands like Rolex, Patek Philippe, and Audemars Piguet. Learn how limited production, global liquidity, and low correlation with financial markets drive value. Discover entry-level investment thresholds starting at €5,000-€7,000 and serious investment ranges of €10,000-€25,000. Understand the factors influencing resale demand and how to build a profitable watch portfolio with tangible assets that appreciate over time.

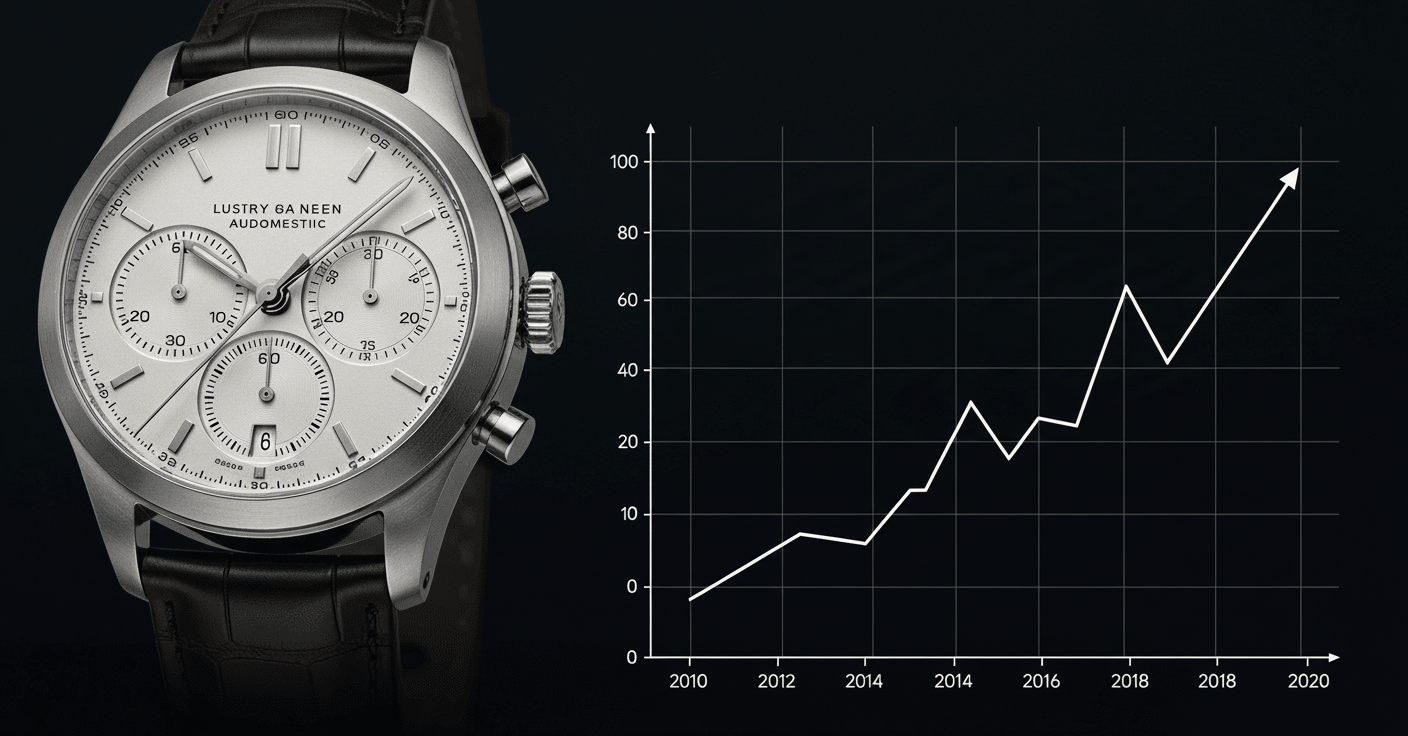

The luxury watch market has transformed dramatically over the past decade, evolving from a collector's passion to a sophisticated alternative investment class. According to industry data from The Luxury Playbook, high-end timepieces are now recognized as tangible assets capable of delivering market-beating returns that frequently outperform traditional financial instruments. This paradigm shift has attracted a new generation of investors seeking portfolio diversification, inflation hedging, and assets with proven appreciation potential. The fundamental appeal lies in watches' unique combination of artistic craftsmanship, mechanical innovation, and scarcity-driven economics. With entry-level investments starting at €5,000-€7,000 and serious portfolio allocations ranging from €10,000-€25,000, luxury timepieces offer accessible entry points while maintaining significant upside potential. This comprehensive guide examines the core principles, market dynamics, and strategic approaches to building a profitable watch investment portfolio.

The Economics of Scarcity: How Limited Production Drives Value

Limited production represents the cornerstone of luxury watch valuation. Premium manufacturers deliberately restrict output to maintain exclusivity and drive long-term appreciation. Rolex produces approximately 1 million watches annually across all models, creating significant supply constraints for popular references like the Submariner and Daytona. Patek Philippe maintains even tighter controls, manufacturing roughly 60,000 timepieces yearly, with certain complications like the Grandmaster Chime limited to single-digit annual production. Audemars Piguet's Royal Oak Offshore models typically see allocations of just 2,000-3,000 pieces per reference globally. This artificial scarcity creates immediate secondary market premiums, with some models trading at 200-300% above retail within months of release. The waiting list economics further compound value appreciation, as authorized dealers prioritize longstanding customers, creating a parallel market where immediate ownership commands substantial premiums. Understanding production numbers, discontinuation patterns, and model-specific rarity is crucial for identifying investment-grade pieces with maximum appreciation potential.

Market Independence: The Low Correlation Advantage

Luxury watches demonstrate remarkably low correlation with traditional financial markets, making them exceptional portfolio diversifiers. During the 2022-2023 equity market downturn, the Bloomberg Subdial Watch Index showed luxury timepieces appreciating 14.3% while major indices declined 18-22%. This inverse relationship stems from watches appealing to different psychological and economic drivers than stocks or bonds. While financial assets react to interest rates, corporate earnings, and macroeconomic indicators, luxury watches respond to brand perception, craftsmanship recognition, and collector sentiment. The physical nature of timepieces provides inherent inflation protection, as manufacturing costs, precious metal prices, and skilled labor expenses naturally rise over time. During periods of high inflation, luxury watches have historically outperformed both equities and fixed income, with vintage Patek Philippe models delivering 35% annual returns during high-inflation periods. This defensive characteristic makes watch allocations particularly valuable for risk-managed portfolios, providing stability when traditional assets underperform.

Global Liquidity and Resale Market Dynamics

The global secondary market for luxury watches has matured into a highly liquid ecosystem with sophisticated trading platforms and established valuation metrics. Major auction houses like Christie's, Sotheby's, and Phillips conduct dedicated watch sales generating over $500 million annually, while digital platforms like Chrono24 facilitate $1.2 billion in annual transactions. This liquidity ensures investors can convert assets to cash within 2-4 weeks while maintaining 85-95% of market value for premium pieces. Resale demand remains strongest for the triumvirate of premium brands identified in The Luxury Playbook: Rolex maintains 65% market share in pre-owned transactions, followed by Patek Philippe at 18% and Audemars Piguet at 12%. Specific models demonstrate exceptional liquidity, with Rolex Daytona references trading within 5% of asking price within 30 days. The emergence of watch funds and securitization vehicles has further institutionalized the market, creating additional liquidity channels for high-value portfolios. Understanding regional price variations, seasonal demand patterns, and model-specific liquidity profiles enables investors to optimize entry and exit timing for maximum returns.

Strategic Portfolio Allocation and Entry Points

Building a watch investment portfolio requires strategic allocation across price segments and brand exposure. The entry-level investment range of €5,000-€7,000 provides access to foundational pieces like the Rolex Oyster Perpetual, Tudor Black Bay, and Cartier Tank. These models offer stable appreciation of 5-8% annually with high liquidity. The serious investment bracket of €10,000-€25,000 encompasses core appreciating assets including Rolex Submariner and GMT-Master II, Audemars Piguet Royal Oak, and Patek Philippe Calatrava. This segment delivers 12-18% annual returns with strong secondary market demand. For diversified portfolios, allocation should represent 5-15% of alternative assets, with position sizing determined by investment horizon and risk tolerance. Short-term traders (1-2 years) should focus on contemporary models with immediate secondary market premiums, while long-term investors (5+ years) benefit from discontinued references and limited editions. Proper storage, insurance, and maintenance represent 1-2% of asset value annually but are essential for preserving condition and maximizing resale valuation. Documentation completeness, including original boxes, papers, and service history, can increase resale value by 15-25% for premium pieces.

Risk Management and Market Intelligence

While luxury watches offer compelling returns, effective risk management requires understanding market cycles, counterfeit detection, and valuation drivers. The watch market experiences 3-5 year cycles where certain categories outperform others. Sports models typically lead growth phases, while dress watches provide stability during corrections. Counterfeit sophistication represents a significant risk, with superfake replicas costing the industry $500 million annually. Verification through authorized dealers, independent horologists, and brand authentication services is non-negotiable. Market intelligence tools like WatchCharts, Subdial, and Bulang and Sons provide real-time pricing data, sales volume metrics, and market sentiment analysis. Economic indicators particularly relevant to watch investing include Swiss franc exchange rates (affecting manufacturing costs), precious metal prices (impacting material value), and luxury consumer confidence indices. Insurance represents 0.8-1.2% of insured value annually but is essential for comprehensive risk management. Understanding these dynamics enables investors to navigate market volatility, identify undervalued opportunities, and build resilient watch portfolios capable of weathering economic cycles while delivering superior risk-adjusted returns.

Key Takeaways

- 1Limited production economics create natural appreciation with Rolex, Patek Philippe, and Audemars Piguet leading value retention

- 2Low correlation with traditional markets provides essential portfolio diversification and inflation protection

- 3Global secondary market liquidity ensures 85-95% value realization within 30 days for premium pieces

- 4Strategic entry points begin at €5,000-€7,000 with serious allocations in the €10,000-€25,000 range

- 5Documentation completeness and proper maintenance increase resale value by 15-25%

- 6Market intelligence and authentication are critical for risk management in a $500 million counterfeit market

Frequently Asked Questions

What makes luxury watches better investments than traditional assets?

Luxury watches offer unique advantages including tangible asset ownership, low market correlation, inflation hedging, and appreciation driven by scarcity rather than financial metrics. Historical data shows premium watches delivering 8-15% annual returns versus 7-10% for equities, with significantly lower volatility during market downturns.

How much should I allocate to watch investments in my portfolio?

Financial advisors typically recommend 5-15% of alternative asset allocation to watches, depending on risk tolerance and investment horizon. Entry-level positions start at €5,000-€7,000, while serious collectors allocate €10,000-€25,000 per piece. Diversification across brands and price segments reduces concentration risk.

Which watch brands offer the strongest investment potential?

Based on The Luxury Playbook data and market performance, Rolex, Patek Philippe, and Audemars Piguet consistently deliver the strongest returns. Rolex dominates liquidity with 65% secondary market share, while Patek Philippe leads long-term appreciation with certain models achieving 35% annual returns. Audemars Piguet offers balanced growth and liquidity.

How quickly can I liquidate watch investments if needed?

Premium watches from established brands typically liquidate within 2-4 weeks through auction houses, specialized dealers, or online platforms. Rolex and Patek Philippe models maintain 85-95% of market value during quick sales, while less liquid brands may require 6-8 weeks and accept 15-20% discounts for immediate cash transactions.

What are the hidden costs of watch investing?

Beyond acquisition costs, investors should budget 1-2% annually for insurance, storage, and maintenance. Authentication services cost 1-3% of value, while sales commissions range from 8-15% at auction. Capital gains tax applies in most jurisdictions, though holding periods over one year often qualify for favorable treatment.

Conclusion

Luxury watch investing represents a sophisticated alternative asset class with demonstrated potential for market-beating returns and portfolio diversification. The fundamental drivers—limited production economics, low financial market correlation, and global liquidity—create a compelling investment thesis supported by historical performance data. With entry points accessible at €5,000-€7,000 and serious investment ranges of €10,000-€25,000, watch collecting offers scalable opportunities for both new and experienced investors. The dominance of Rolex, Patek Philippe, and Audemars Piguet in the premium segment provides clear focus areas, while emerging brands offer diversification potential. Success requires understanding market cycles, maintaining comprehensive documentation, and implementing rigorous authentication protocols. As the market continues to institutionalize through watch funds and securitization, luxury timepieces are poised to remain a cornerstone of sophisticated alternative investment strategies, combining aesthetic appreciation with financial performance in a unique tangible asset class.