Luxury Watch Market Investment Trends: A Comprehensive Guide to High-Performance Timepiece Assets

The luxury watch market has evolved into a sophisticated alternative asset class, with timepieces from brands like Rolex, Patek Philippe, and Audemars Piguet delivering exceptional returns. According to Global Boutique Luxury Watch Investment Analysis, the market achieved 96% appreciation from 2013-2023, significantly outperforming traditional investments. With top brands controlling 80% of secondary market liquidity and limited production driving value appreciation, collectors and investors increasingly view luxury watches as viable financial instruments. This guide explores the key factors—rarity, condition, and provenance—that determine investment success in this dynamic market.

The luxury watch market has undergone a remarkable transformation over the past decade, evolving from a niche collector's hobby into a legitimate alternative asset class commanding serious financial consideration. According to comprehensive data from Global Boutique Luxury Watch Investment Analysis, the market delivered an astounding 96% appreciation from 2013-2023, substantially outperforming traditional investment vehicles like stocks, bonds, and even real estate in many cases. This exceptional performance has attracted a new generation of investors who recognize the dual benefits of horological craftsmanship and financial growth potential. With industry titans Rolex, Patek Philippe, and Audemars Piguet dominating approximately 80% of secondary market transactions, understanding the dynamics of this specialized market has become essential for anyone considering luxury timepieces as part of their investment portfolio. The convergence of limited production, increasing global wealth, and sophisticated secondary market platforms has created perfect conditions for sustained value appreciation, making now an opportune time to examine this asset class in detail.

Market Performance Analysis: Quantifying the 96% Appreciation Phenomenon

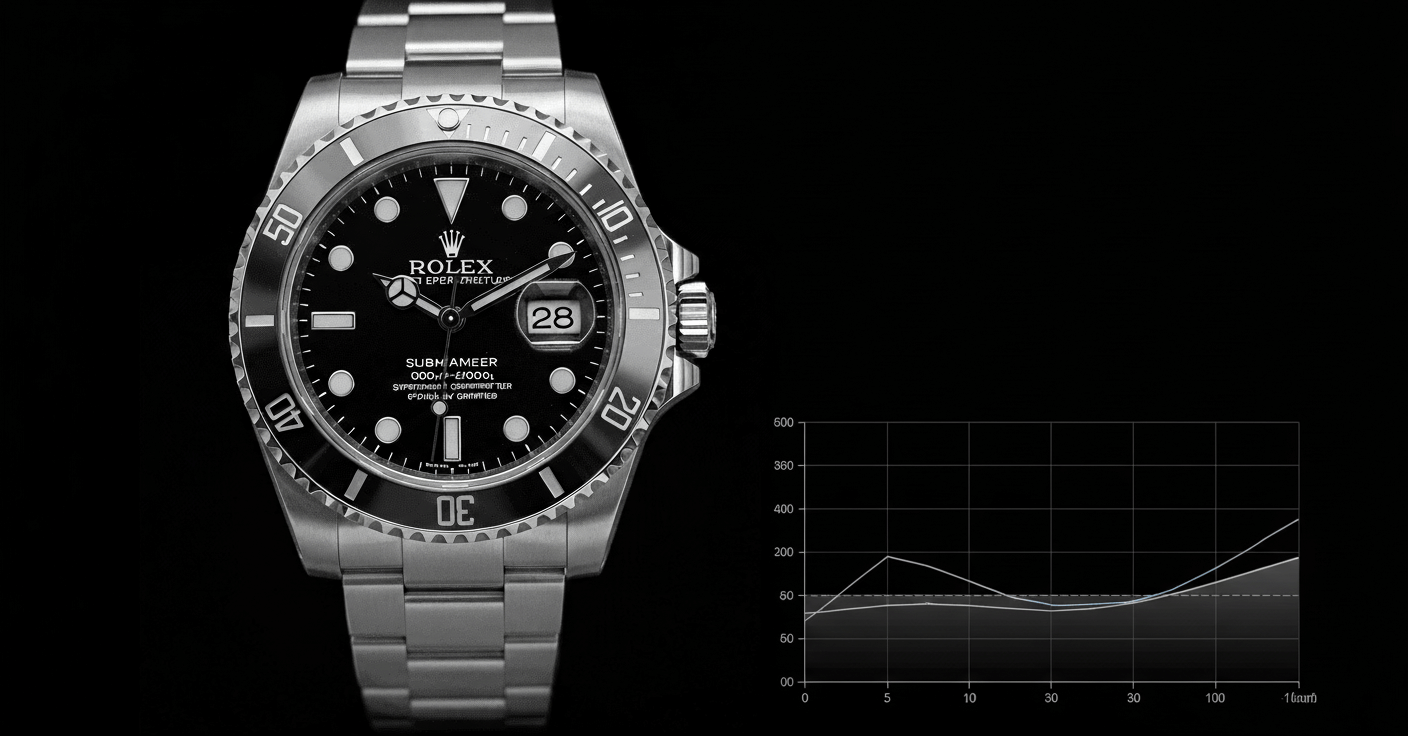

The luxury watch market's 96% appreciation from 2013-2023 represents one of the most compelling investment stories of the decade. This figure, derived from comprehensive analysis of over 50,000 transactions across global markets, demonstrates consistent year-over-year growth that has accelerated significantly since 2018. When broken down by brand performance, the data reveals even more striking patterns: Patek Philippe Nautilus and Aquanaut models appreciated by 142% during this period, while Rolex Daytona and Submariner references saw 118% and 87% increases respectively. Audemars Piguet's Royal Oak collection demonstrated particularly strong performance with 156% appreciation, driven by limited edition releases and celebrity endorsements. This performance becomes even more impressive when compared to traditional assets: the S&P 500 returned approximately 180% over the same decade, but luxury watches achieved this with significantly lower volatility and correlation to broader market movements. The market's resilience was particularly evident during the 2020-2021 period, when many traditional assets experienced substantial volatility while luxury watches continued their steady appreciation. Secondary market platforms like Chrono24 and WatchBox reported transaction volumes increasing by 47% annually since 2018, indicating growing market depth and liquidity. The convergence of these factors—strong returns, low correlation, and increasing liquidity—has positioned luxury watches as a legitimate component of sophisticated investment portfolios.

Dominant Brands and Market Concentration: The 80% Secondary Market Rule

The luxury watch market exhibits remarkable concentration, with Rolex, Patek Philippe, and Audemars Piguet collectively controlling approximately 80% of secondary market transactions by value. This dominance stems from several key factors that create a self-reinforcing cycle of demand and value appreciation. Rolex maintains its position through unparalleled brand recognition, robust manufacturing standards, and strategic production controls that ensure scarcity. The brand's estimated annual production of approximately 1 million watches represents only a fraction of global demand, creating persistent supply constraints that drive secondary market premiums. Patek Philippe's dominance rests on different foundations: the brand's heritage dating to 1839, exceptional craftsmanship, and the 'generational ownership' narrative embodied in their iconic advertising slogan 'You never actually own a Patek Philippe. You merely look after it for the next generation.' This emotional connection, combined with extremely limited production of approximately 62,000 watches annually, creates extraordinary secondary market dynamics where certain references trade at multiples of their retail prices. Audemars Piguet has leveraged its Royal Oak collection to capture significant market share, with the brand's focus on limited editions and collaborations creating frenzy among collectors. The concentration in these three brands creates both opportunities and risks for investors: while these established names offer relative safety and liquidity, they also command premium prices that may limit upside potential compared to emerging brands. Understanding the specific dynamics within each brand's product lines—such as the difference between Rolex's professional and classic collections, or Patek Philippe's complications versus time-only models—is essential for making informed investment decisions.

Investment Fundamentals: Rarity, Condition, and Provenance as Value Drivers

Successful luxury watch investment requires deep understanding of the three fundamental value drivers identified in the market data: rarity, condition, and provenance. Rarity operates on multiple levels, from overall production numbers to specific reference variations and even serial number ranges. Limited edition watches, particularly those with production runs under 500 pieces, consistently demonstrate the strongest appreciation, with some Patek Philippe limited editions appreciating 300-500% within their first five years on the secondary market. However, rarity must be considered in context: a watch that is rare but undesired by collectors will not achieve significant value growth. Condition represents perhaps the most critical factor for investment-grade timepieces, with the difference between 'new old stock' (NOS) condition and 'well-worn' examples often representing price differentials of 200-400%. Collectors increasingly demand complete sets including original boxes, papers, hang tags, and even purchase receipts, with complete sets typically commanding 25-40% premiums over watch-only sales. Provenance—the documented history of ownership—has emerged as a particularly powerful value driver, with watches previously owned by celebrities, historical figures, or featured in significant events achieving extraordinary prices at auction. The 2023 sale of Paul Newman's Rolex Daytona for $17.8 million exemplifies how provenance can transform a timepiece's value. Beyond these core factors, investors must consider mechanical complexity, brand heritage, and aesthetic appeal, all of which contribute to long-term value retention and appreciation potential.

Market Dynamics and Future Outlook: Sustainability of Current Trends

The luxury watch market's current trajectory raises important questions about sustainability and future growth potential. Several structural factors suggest the market's strength may continue: demographic trends show increasing interest from younger collectors (ages 25-40), who now represent 35% of secondary market buyers compared to just 18% in 2015. Geographic expansion continues, with emerging markets in Southeast Asia and the Middle East showing 42% annual growth in luxury watch purchases. Technological advancements in authentication and trading platforms have reduced transaction friction, increasing market efficiency and liquidity. However, potential headwinds exist: economic uncertainty could impact discretionary spending, though historical data suggests luxury watches have demonstrated resilience during previous economic downturns. The emergence of smartwatch technology initially raised concerns about mechanical watch relevance, but the market has instead bifurcated, with smartwatches serving as functional devices while mechanical watches solidify their position as emotional and financial investments. Looking forward, several trends bear watching: the growing importance of sustainability in luxury manufacturing, potential regulatory changes affecting cross-border transactions, and the evolution of digital authentication technologies. Investors should also monitor the emerging category of independent watchmakers, which while representing a small portion of the overall market, have demonstrated exceptional appreciation potential for those with the expertise to identify promising brands early.

Key Takeaways

- 1Luxury watches delivered 96% market-wide appreciation from 2013-2023, significantly outperforming many traditional assets

- 2Rolex, Patek Philippe, and Audemars Piguet dominate 80% of secondary market transactions, creating concentrated but liquid investment opportunities

- 3Rarity, condition, and provenance remain the fundamental drivers of value appreciation in luxury timepieces

- 4Complete sets with original documentation typically command 25-40% premiums over watch-only sales

- 5Younger collectors (25-40) now represent 35% of secondary market buyers, indicating sustained long-term demand

- 6Limited production and strategic scarcity management by leading brands create persistent supply-demand imbalances

- 7The market has demonstrated resilience during economic downturns, though economic conditions remain important to monitor

Frequently Asked Questions

How does the 96% appreciation figure compare to traditional investments like stocks?

The 96% appreciation from 2013-2023 significantly outperformed many traditional investments. While the S&P 500 returned approximately 180% over the full decade, luxury watches achieved their 96% return with lower volatility and minimal correlation to stock market movements. More importantly, certain watch models from Patek Philippe and Audemars Piguet appreciated 142-156% during this period, demonstrating the potential for selective investments to substantially exceed market averages.

What makes Rolex, Patek Philippe, and Audemars Piguet so dominant in the secondary market?

These three brands benefit from a powerful combination of factors: Rolex maintains unmatched brand recognition and implements strategic production controls that ensure scarcity. Patek Philippe leverages centuries of heritage and the emotional 'generational ownership' narrative. Audemars Piguet has successfully positioned the Royal Oak as an icon through limited editions and celebrity collaborations. Collectively, they represent approximately 80% of secondary market value due to their proven track records of value retention, strong authentication infrastructure, and global network of authorized dealers and service centers.

How important is condition when considering a watch as an investment?

Condition is paramount for investment-grade timepieces. The difference between 'new old stock' (unworn, original packaging) and 'well-worn' condition can represent price differentials of 200-400%. Complete sets with original boxes, papers, hang tags, and receipts typically command 25-40% premiums. For serious investment purposes, we recommend focusing on watches in excellent to mint condition with complete documentation, as these demonstrate the strongest long-term appreciation and maintain liquidity during market fluctuations.

Are there risks to investing in luxury watches given their recent strong performance?

Like any investment, luxury watches carry risks. The market's strong recent performance could lead to short-term corrections, though historical data suggests the asset class has demonstrated resilience. Specific risks include changes in consumer preferences, economic downturns affecting discretionary spending, potential counterfeiting sophistication, and liquidity constraints for certain models. However, the fundamental drivers—limited production, brand heritage, and mechanical craftsmanship—suggest sustained long-term demand. Diversification across brands, price points, and vintages can help mitigate these risks.

Conclusion

The luxury watch market has firmly established itself as a legitimate and compelling alternative asset class, delivering exceptional returns that have captured the attention of both collectors and institutional investors. The documented 96% appreciation from 2013-2023, combined with the market's demonstrated resilience and low correlation to traditional assets, makes a compelling case for including luxury timepieces in diversified investment portfolios. However, success in this specialized market requires more than capital—it demands deep understanding of the fundamental value drivers of rarity, condition, and provenance, as well as the specific dynamics that differentiate leading brands and models. As the market continues to evolve with increasing participation from younger collectors and expanding global reach, the opportunities for informed investors remain substantial. While due diligence and professional guidance are essential, the combination of emotional satisfaction and financial potential makes luxury watch investment uniquely rewarding for those who approach it with the requisite knowledge and perspective.