Luxury Watch Investment Strategies: Maximizing Returns on Rolex, Bvlgari, and Louis Vuitton Timepieces

This comprehensive guide explores proven luxury watch investment strategies, detailing how to achieve 15-20% short-term profits or triple-digit long-term appreciation. Learn critical factors including model rarity, market demand dynamics, and the importance of original documentation. Discover how to navigate both retail and secondary markets for Rolex, Bvlgari, and Louis Vuitton watches while understanding key considerations like limited production numbers, condition assessment, and brand limitations. Master the art of luxury timepiece investment with data-driven approaches from industry experts.

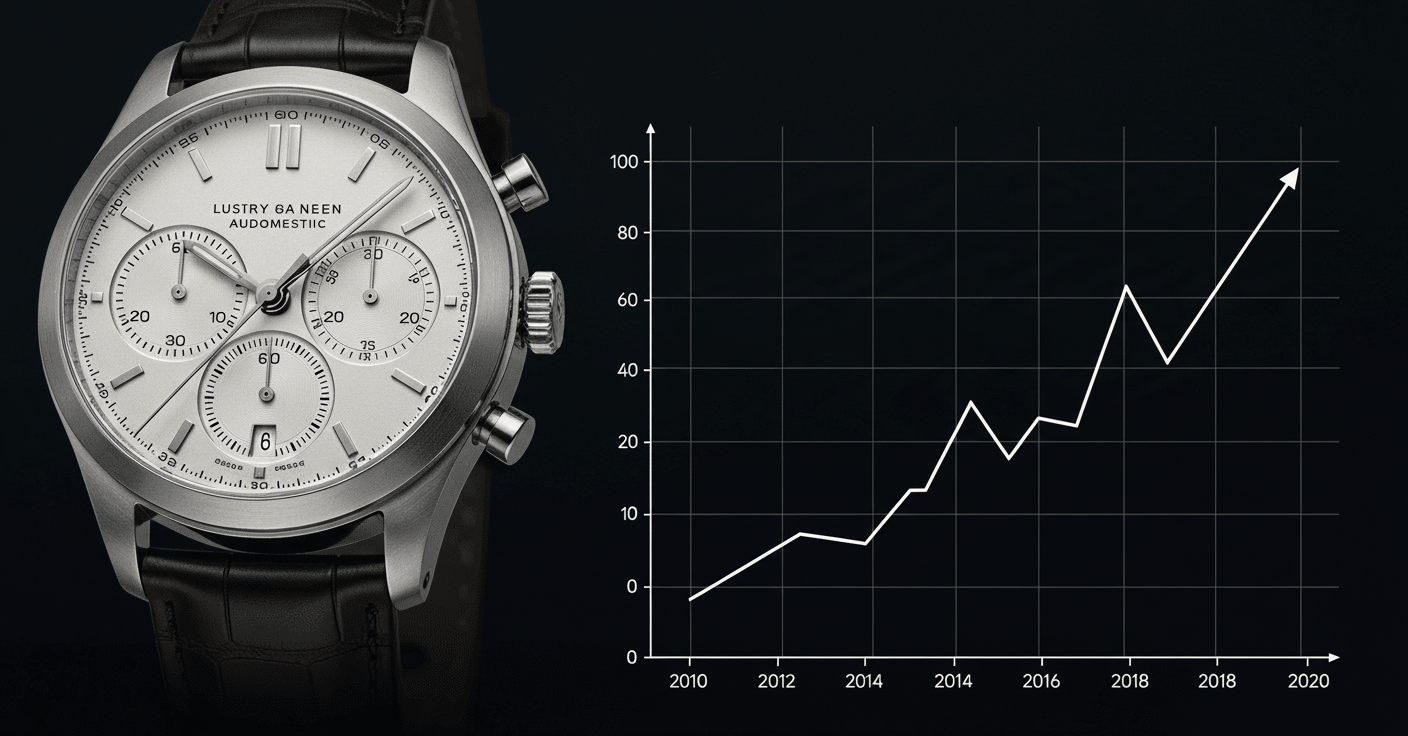

The luxury watch market has evolved from mere timekeeping to sophisticated investment vehicles, with certain timepieces outperforming traditional financial instruments. According to The Luxury Playbook, successful watch investment requires careful consideration of multiple factors, including model rarity, market demand, and long-term appreciation potential. At Rolex-Buy-Sell.com, we've witnessed firsthand how strategic acquisitions of Rolex, Bvlgari, and Louis Vuitton watches can generate substantial returns, with market premiums reaching 10%-50% above retail for coveted models. This comprehensive guide demystifies the complex landscape of luxury watch investing, providing actionable strategies for both novice collectors and seasoned investors seeking to build a profitable horological portfolio.

Defining Your Investment Strategy and Time Horizon

Successful luxury watch investment begins with clearly defining your objectives and time horizon. Short-term strategies targeting 15-20% profit within 12 months require different approaches than long-term holdings seeking triple-digit appreciation over several years. Short-term investors typically focus on recently discontinued models, limited editions with immediate market buzz, or watches experiencing temporary supply constraints. These opportunities demand active market monitoring and quick execution. Long-term investors, conversely, prioritize historical performance data, brand legacy, and proven appreciation patterns. Rolex Daytona models, for instance, have demonstrated consistent triple-digit growth over 5-10 year periods, with certain vintage references appreciating over 300% from original retail prices. Your investment intent should align with your risk tolerance, capital availability, and market knowledge level.

Understanding Market Dynamics and Brand Limitations

The luxury watch market operates on complex dynamics where brand perception, production limitations, and consumer demand intersect. Rolex maintains its dominance through controlled distribution and consistent quality, creating artificial scarcity that drives secondary market premiums of 10%-50% above retail for models like the GMT-Master II and Submariner. Bvlgari has gained significant traction with its Octo Finissimo collection, leveraging ultra-thin movement technology and contemporary design to capture market share. Louis Vuitton's Tambour watches combine horological excellence with fashion prestige, appealing to collectors seeking both technical merit and brand cachet. Understanding these brand limitations—including production caps, authorized dealer networks, and discontinuation patterns—is crucial for identifying investment opportunities. Market dynamics also involve macroeconomic factors; during economic uncertainty, vintage Rolex models often outperform contemporary releases due to their perceived stability and historical significance.

Navigating Retail vs. Secondary Market Opportunities

Investors must strategically balance retail acquisitions against secondary market purchases. Retail purchases offer warranty protection and provenance certainty but often involve waiting lists and limited availability for premium models like the Rolex Daytona or Bvlgari Octo Finissimo Tourbillon. Secondary markets provide immediate access and potentially better pricing for discontinued references but require meticulous verification processes. The secondary market for luxury watches has matured significantly, with established platforms offering authentication services and buyer protection. When considering secondary market options, focus on sellers with proven track records, transparent pricing history, and comprehensive documentation. For retail purchases, build relationships with authorized dealers to access allocation opportunities for limited edition pieces. Hybrid strategies—acquiring contemporary models at retail while selectively purchasing vintage pieces on the secondary market—can diversify risk and maximize portfolio growth potential across different market segments.

Critical Investment Considerations: Documentation and Condition

Investment-grade luxury watches demand impeccable documentation and condition. Original box and papers can increase value by 15-30% compared to naked watches, as they provide provenance verification and completeness that serious collectors demand. Condition assessment goes beyond cosmetic appearance; movement service history, case integrity, and originality of components significantly impact long-term value. Watches with complete service records from manufacturer-authorized facilities command premium prices. Limited production numbers create inherent scarcity; Rolex's 'Paul Newman' Daytona reference 6263, with only approximately 2,000 units produced, has reached auction prices exceeding $17 million. Similarly, Bvlgari's Gerald Genta-designed retrograde models and Louis Vuitton's Minute Repeater limited editions benefit from production caps that ensure long-term appreciation. Provenance—particularly celebrity ownership or historical significance—can multiply value exponentially, making research and documentation verification paramount to investment success.

Key Takeaways

- 1Define clear investment intent: target 15-20% short-term profits or triple-digit long-term appreciation

- 2Understand brand-specific market dynamics, including Rolex's artificial scarcity and Bvlgari's technological innovation

- 3Balance retail acquisitions (warranty protection) with secondary market opportunities (immediate access)

- 4Prioritize original box, papers, and complete documentation for 15-30% value premium

- 5Focus on limited production models and impeccable condition for maximum appreciation potential

- 6Consider hybrid strategies combining contemporary retail purchases with selective vintage acquisitions

Frequently Asked Questions

What percentage above retail can I expect to pay for coveted luxury watch models?

Market premiums for highly sought-after models typically range from 10%-50% above retail, with certain Rolex professional models like the GMT-Master II 'Pepsi' and Daytona 'Ceramic' consistently commanding 30-50% premiums due to extreme demand and limited supply.

How important are original box and papers for investment value?

Extremely important—complete sets with original box, papers, hang tags, and warranty documentation can increase resale value by 15-30% compared to naked watches. This documentation provides crucial provenance verification that serious collectors demand.

What are the key differences between short-term and long-term watch investment strategies?

Short-term strategies target 15-20% profits within 12 months by capitalizing on market fluctuations, limited edition releases, or temporary supply constraints. Long-term approaches seek triple-digit appreciation over several years through strategic acquisitions of historically proven models with strong brand legacy and limited production numbers.

Which luxury watch brands offer the best investment potential?

Rolex consistently leads with strong secondary market performance, while Bvlgari has shown remarkable growth with its Octo Finissimo collection. Louis Vuitton offers unique opportunities combining fashion prestige with horological excellence. Ultimately, specific models within each brand matter more than the brand alone.

Conclusion

Luxury watch investment represents a sophisticated alternative asset class that combines passion with profit potential. By implementing the strategies outlined—clarifying investment intent, understanding market dynamics, navigating multiple acquisition channels, and prioritizing documentation and condition—investors can build portfolios capable of generating substantial returns. The data from The Luxury Playbook confirms that disciplined approach to luxury watch investing can yield 15-20% short-term profits or triple-digit long-term appreciation, particularly when focusing on models with limited production numbers and strong brand heritage. As the market continues to evolve, staying informed about emerging trends and maintaining relationships with trusted dealers will remain essential for maximizing investment success in the dynamic world of Rolex, Bvlgari, and Louis Vuitton timepieces.