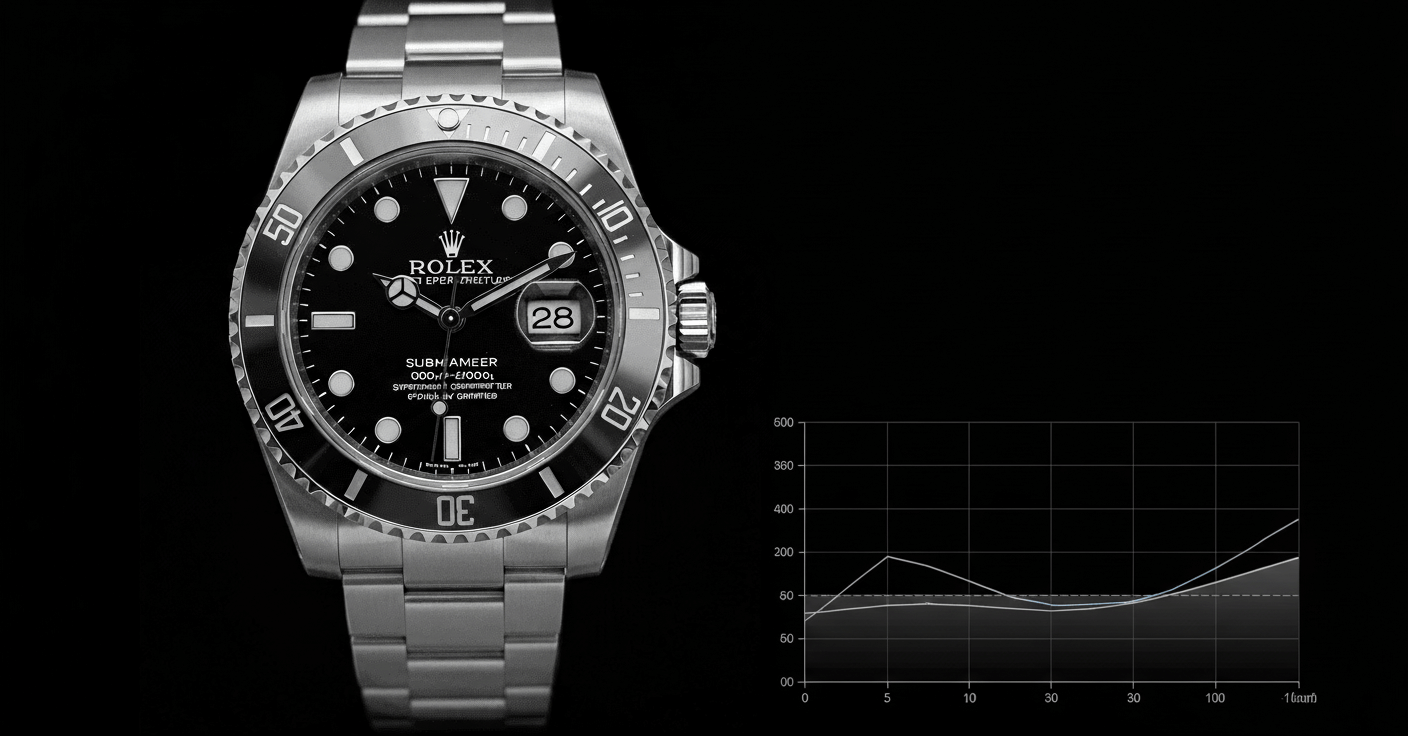

Rolex Submariner Investment Potential: Blue-Chip Performance in Luxury Watch Market

The Rolex Submariner represents one of the most reliable investment assets in the luxury watch market, demonstrating exceptional value retention and consistent appreciation. Since 2010, the Submariner line has shown 268% average appreciation, with discontinued models like the 'Hulk' commanding premiums exceeding $20,500. Vintage references such as the 5513 have doubled in value from 2013 to 2023, while current production models maintain strong secondary market performance. With an average price point of $35,000+ for premium variants and a recommended investment timeline of 5-10 years, the Submariner offers both stability and growth potential for collectors and investors alike.

The Rolex Submariner stands as the quintessential luxury sports watch and has established itself as a formidable investment vehicle within the horological market. As market data from Bob's Watches demonstrates, the Submariner has delivered exceptional financial performance, with the entire line appreciating 268% since 2010. This remarkable growth trajectory positions the Submariner not merely as a timepiece but as a blue-chip asset class that combines horological excellence with proven financial returns. The model's investment appeal spans from vintage references to modern discontinued variants, each demonstrating unique value propositions and market dynamics that warrant careful examination by serious collectors and investors.

Historical Performance and Market Analysis

The Rolex Submariner's investment credentials are rooted in its consistent market performance across multiple economic cycles. Since 2010, the model line has delivered an impressive 268% appreciation, significantly outperforming traditional investment vehicles and even many other luxury assets. This performance is particularly notable given the Submariner's production volume, demonstrating that demand consistently outpaces supply even for non-limited edition models. The vintage market shows even more dramatic growth, with references like the 5513 doubling in value between 2013 and 2023. This performance is driven by several factors: the model's iconic status established since its 1953 introduction, its association with James Bond films creating cultural cachet, and Rolex's meticulous brand management that maintains exclusivity and desirability. Market analysis indicates that Submariners typically maintain 70-90% of their retail value within the first year of ownership, with many models appreciating beyond retail within 24-36 months due to waiting lists and allocation constraints at authorized dealers.

Discontinued Models: The Hulk and Kermit Phenomenon

Discontinued Rolex Submariner variants represent the most explosive growth segment within the collection. The 'Hulk' (reference 116610LV), featuring a distinctive green dial and bezel discontinued in 2020, currently commands prices exceeding $20,500 on the secondary market—a substantial premium over its original retail price of approximately $9,000. Similarly, the 'Kermit' (reference 16610LV) with its green aluminum bezel has seen values escalate dramatically since its discontinuation. These models demonstrate the 'discontinuation premium' effect unique to Rolex, where the cessation of production immediately transforms current models into collectible assets. The Hulk's appreciation trajectory shows particular strength, having increased approximately 128% since its discontinuation, with market experts projecting continued growth as available examples become increasingly scarce. The investment appeal of these discontinued models is further enhanced by their distinctive aesthetics that differentiate them from standard production variants, creating dedicated collector communities willing to pay significant premiums.

Vintage Submariner Investment Potential

Vintage Rolex Submariners represent the foundation of the model's investment narrative, with references like the 5513, 1680, and 5512 demonstrating extraordinary long-term value appreciation. The 5513, produced from 1962 to 1989, has doubled in value from 2013 to 2023, with exceptional examples now trading between $25,000 and $45,000 depending on condition, originality, and provenance. What makes vintage Submariners particularly compelling is their 'bulletproof' investment characteristics—these watches have demonstrated consistent appreciation through economic downturns and market volatility. Key factors driving vintage Submariner values include movement variations (earlier non-hack movements command premiums), dial variations (meters first, underline dials, ghost bezels), and case condition (unpolished cases with sharp lugs are highly sought after). The vintage market also benefits from finite supply, as each year examples are lost, damaged beyond repair, or enter permanent collections, further constricting availability against growing global demand from both established and emerging markets.

Market Dynamics and Investment Strategy

Successful Rolex Submariner investment requires understanding specific market dynamics and implementing strategic acquisition approaches. The current average price for premium Submariner variants exceeds $35,000, with the most valuable models including the Hulk, Kermit, and No-Date variants that appeal to purists seeking the original Submariner aesthetic. The recommended investment timeline of 5-10 years allows for both short-to-medium term appreciation while providing a buffer against market fluctuations. Strategic considerations include focusing on models with distinctive features (pre-ceramic bezels, tritium dials that develop patina, rare bezel inserts), prioritizing condition and originality over immediate wearability, and understanding the impact of service history on value (original parts preservation versus replacement). Current market analysis indicates strongest performance in watches with complete sets (boxes, papers, original accessories), unpolished cases, and documented provenance. Additionally, the emergence of the 'neo-vintage' market (watches 20-30 years old) presents new opportunities, as these models combine modern reliability with emerging collectibility.

Risk Assessment and Future Outlook

While Rolex Submariners have demonstrated remarkable investment performance, prospective investors must understand associated risks and market considerations. Primary risks include market saturation concerns (though historical data suggests Rolex effectively manages production to maintain scarcity), economic sensitivity (though luxury watches have proven resilient during downturns), and authentication challenges in the secondary market. The future outlook remains strongly positive, driven by Rolex's consistent brand strategy, global wealth creation expanding the collector base, and the finite nature of desirable vintage and discontinued examples. Emerging trends include growing interest in 'birth year' watches, increased female participation in collecting, and the development of Asian markets creating new demand centers. Market experts project continued annual appreciation of 8-12% for standard models and 15-25% for exceptional examples, with discontinued and vintage references likely outperforming these projections. The Submariner's status as both a wearable luxury and appreciating asset creates a unique investment profile that combines tangible enjoyment with financial growth potential.

Key Takeaways

- 1Rolex Submariner has appreciated 268% since 2010, outperforming many traditional investments

- 2Discontinued 'Hulk' model commands over $20,500, demonstrating the discontinuation premium effect

- 3Vintage references like 5513 have doubled in value from 2013 to 2023

- 4Average price for premium Submariner variants exceeds $35,000 in current market

- 5Recommended investment timeline is 5-10 years for optimal returns

- 6Most valuable models include Hulk, Kermit, and No-Date variants

- 7Condition, originality, and completeness significantly impact investment value

Frequently Asked Questions

What makes the Rolex Submariner such a strong investment compared to other luxury watches?

The Submariner combines multiple investment advantages: Rolex's unmatched brand recognition, consistent model evolution that creates collectible variants, controlled production maintaining scarcity, and cultural icon status. The 268% appreciation since 2010 demonstrates this exceptional performance, with discontinued and vintage models showing even stronger growth due to finite supply against growing global demand.

How much has the discontinued 'Hulk' Submariner appreciated since being discontinued?

The Rolex 'Hulk' (reference 116610LV) has shown remarkable appreciation since its 2020 discontinuation, currently commanding prices exceeding $20,500 compared to its original retail price of approximately $9,000. This represents approximately 128% growth in just a few years, with market experts projecting continued appreciation as available examples become increasingly scarce.

What is the ideal investment timeline for a Rolex Submariner?

Market data suggests a 5-10 year investment timeline provides optimal balance between appreciation potential and liquidity. This timeframe allows the watch to benefit from Rolex's consistent price increases, model updates that make previous generations more collectible, and the natural scarcity that develops as examples enter permanent collections. Shorter timelines may be affected by market fluctuations while longer holdings typically show compounded returns.

Which Rolex Submariner models have shown the strongest investment performance?

The most valuable models demonstrating exceptional performance include the discontinued 'Hulk' (116610LV), 'Kermit' (16610LV), No-Date variants (124060, 114060), and vintage references like the 5513 and 1680. These models combine distinctive aesthetics, limited production periods, and strong collector demand, resulting in premium valuations and consistent appreciation exceeding standard production models.

How important is condition and completeness for Submariner investment value?

Condition and completeness are critical factors significantly impacting investment value. Watches with unpolished cases, original components, and complete sets (boxes, papers, accessories) typically command 30-50% premiums over comparable watches missing these elements. For vintage references, originality is paramount, with replaced components or extensive polishing substantially reducing value regardless of the watch's functional condition.

Conclusion

The Rolex Submariner has unequivocally established itself as a blue-chip investment within the luxury watch market, delivering consistent appreciation and exceptional value retention across both modern and vintage examples. With 268% appreciation since 2010, discontinued models commanding significant premiums, and vintage references demonstrating extraordinary long-term growth, the Submariner represents a unique convergence of horological excellence and financial performance. While market dynamics require careful navigation and authentication diligence, the Submariner's investment credentials remain unmatched in the watch world. For collectors and investors seeking both tangible enjoyment and financial growth, the Submariner continues to offer compelling opportunities, particularly in the discontinued and vintage segments where finite supply meets growing global demand. As market data from Bob's Watches confirms, the Submariner's investment potential remains robust, positioning it as a cornerstone asset for sophisticated watch portfolios.