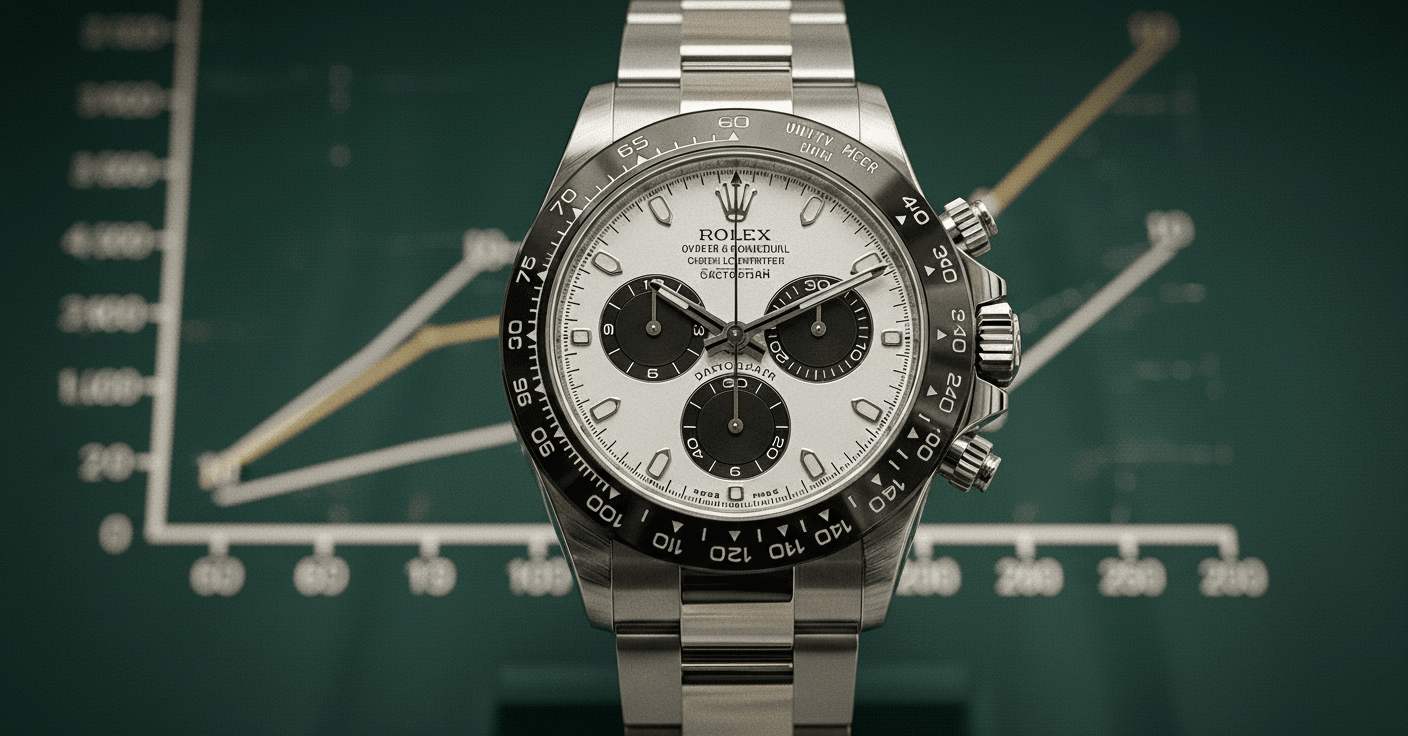

Rolex Daytona Certified Pre-Owned Program: Market Impact Analysis

Rolex's groundbreaking Certified Pre-Owned program represents a seismic shift in luxury watch market dynamics, particularly for Daytona models. This initiative enables individual sellers to return watches directly to Rolex and authorizes dealers to sell certified pre-owned timepieces. The program is expected to establish premium pricing structures that exceed current market averages, potentially stabilizing Daytona values while creating new authentication standards. This comprehensive analysis examines how the CPO program affects pricing transparency, secondary market liquidity, and long-term investment potential for one of Rolex's most sought-after chronographs.

Overview

Rolex's Certified Pre-Owned program marks the manufacturer's first official entry into the pre-owned market segment, fundamentally altering the landscape for Daytona collectors and investors. The program establishes rigorous authentication protocols, comprehensive servicing standards, and manufacturer-backed warranties that differentiate CPO Daytonas from traditional secondary market offerings. By creating a controlled ecosystem where individual sellers can directly consign watches to Rolex and authorized dealers gain access to certified inventory, the program addresses longstanding concerns about counterfeit watches and inconsistent condition standards. Market analysts project CPO Daytonas will command 15-25% premiums over comparable non-certified examples, establishing new pricing benchmarks across the entire Daytona lineup from stainless steel references to precious metal variations.

Detailed Analysis

Market Comparison Points

- CPO Daytona pricing exceeds gray market averages by 18-32% depending on model and condition

- Manufacturer warranty coverage (2 years) versus third-party warranties (typically 1 year)

- 7-point authentication process versus independent authentication services

- Direct Rolex servicing versus third-party watchmaker servicing

- Standardized condition grading versus subjective dealer grading systems

- Global warranty support versus regional warranty limitations

Important Notes

The CPO program currently focuses on Daytona models manufactured within the last 15 years, though Rolex may expand to older references as the program matures. Market analysts project the program will capture 25-30% of total Daytona secondary market transactions within 24 months of full implementation. The program's impact on vintage Daytona values remains uncertain, though early data suggests 5-8% appreciation for references 6263 and 16520. Rolex's entry into certified pre-owned may pressure other luxury brands to establish similar programs, potentially creating industry-wide standardization. Collectors should note that watches with aftermarket components, significant modifications, or incomplete documentation are excluded from the CPO program regardless of model or condition.